Question: Answer only question 2 2. (10 points) Sheronda is an hourly employee at Doc Brown's Shoes. She earns $10.50 per hour and is paid biweekly

Answer only question 2

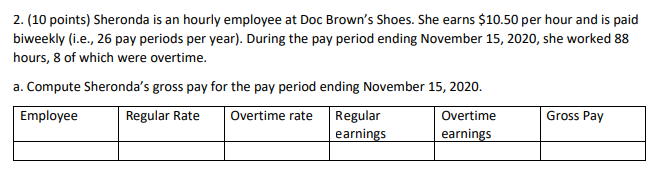

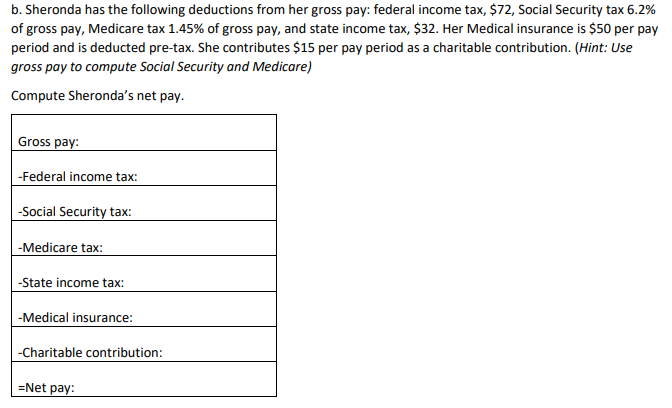

2. (10 points) Sheronda is an hourly employee at Doc Brown's Shoes. She earns $10.50 per hour and is paid biweekly (i.e., 26 pay periods per year). During the pay period ending November 15, 2020, she worked 88 hours, 8 of which were overtime. a. Compute Sheronda's gross pay for the pay period ending November 15, 2020. Employee Regular Rate Overtime rate Regular earnings Overtime earnings Gross Pay b. Sheronda has the following deductions from her gross pay: federal income tax, $72, Social Security tax 6.2% of gross pay, Medicare tax 1.45% of gross pay, and state income tax, $32. Her Medical insurance is $50 per pay period and is deducted pre-tax. She contributes $15 per pay period as a charitable contribution. (Hint: Use gross pay to compute Social Security and Medicare) Compute Sheronda's net pay. Gross pay: -Federal income tax: -Social Security tax: -Medicare tax: -State income tax: -Medical insurance: -Charitable contribution: =Net pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts