Question: answer only question 5 and 6 and solve 13 14 4. A company has an outstanding 20-year bond with a coupon of 8% and a

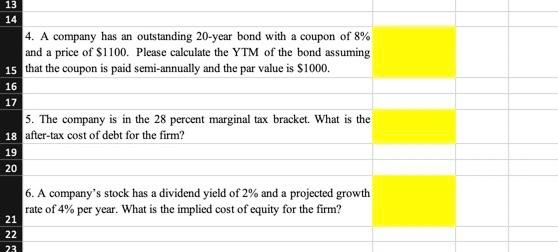

13 14 4. A company has an outstanding 20-year bond with a coupon of 8% and a price of $1100. Please calculate the YTM of the bond assuming 15 that the coupon is paid semi-annually and the par value is $1000. 16 17 5. The company is in the 28 percent marginal tax bracket. What is the 18 after-tax cost of debt for the firm? 19 20 6. A company's stock has a dividend yield of 2% and a projected growth rate of 4% per year. What is the implied cost of equity for the firm? 21 22 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts