Question: answer only question iii (Total 15 marks) QUESTION 4 ZAPS Company limited commenced business on March 1, 2010 preparing accounts to 31 December each year.

answer only question iii

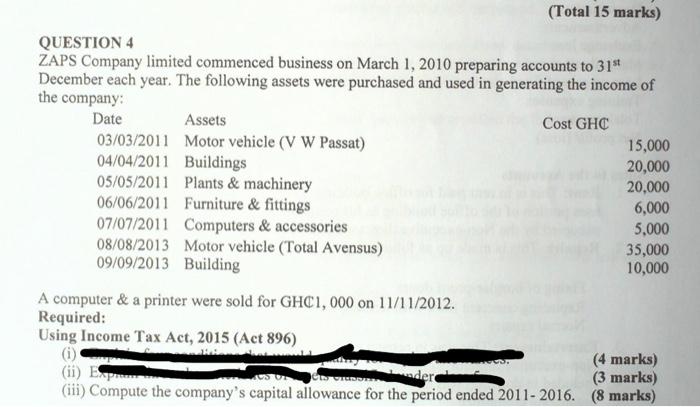

answer only question iii(Total 15 marks) QUESTION 4 ZAPS Company limited commenced business on March 1, 2010 preparing accounts to 31 December each year. The following assets were purchased and used in generating the income of the company: Date Assets Cost GHC 03/03/2011 Motor vehicle (V W Passat) 15,000 04/04/2011 Buildings 20,000 05/05/2011 Plants & machinery 20,000 06/06/2011 Furniture & fittings 6,000 07/07/2011 Computers & accessories 5,000 08/08/2013 Motor vehicle (Total Avensus) 35,000 09/09/2013 Building 10,000 A computer & a printer were sold for GHC1,000 on 11/11/2012. Required: Using Income Tax Act, 2015 (Act 896) (i) (4 marks) (ii) E edere (3 marks) (iii) Compute the company's capital allowance for the period ended 2011- 2016. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts