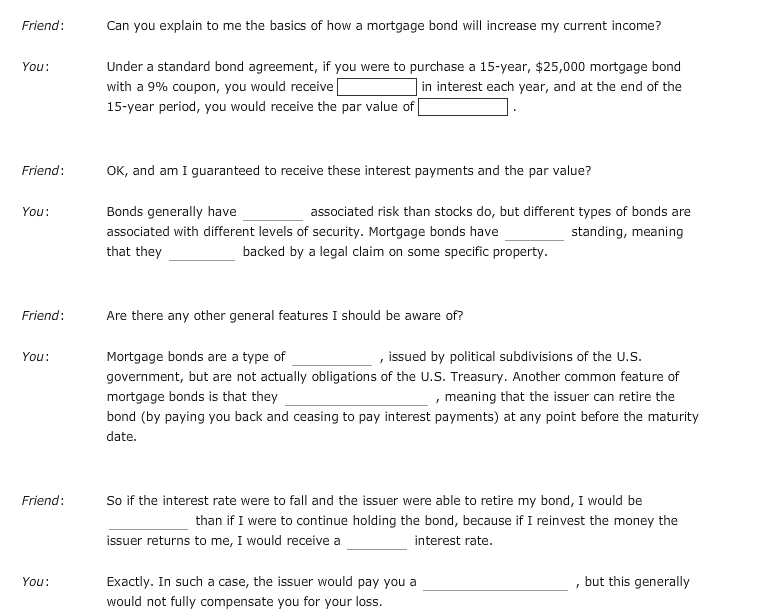

Question: ANSWER OPTIONS ARE IN PARENTHESIS Bonds generally have a (lower, higher) associated risk Mortgage bonds have (senior, junior) standing, that they (are, are not) backed..Mortgage

ANSWER OPTIONS ARE IN PARENTHESIS

Bonds generally have a (lower, higher) associated risk

Mortgage bonds have (senior, junior) standing, that they (are, are not) backed..Mortgage bonds are a type of (agency, municipal)

bonds is that they (carry a deferred call, are noncallable, are freely callable)

I would be (worse off, better off)

I would receive a (lower, higher) interest rate Pay you a (call fee, call premium,repayment premium, recall fee)

Friend: Can you explain to me the basics of how a mortgage bond will increase my current income? Under a standard bond agreement, if you were to purchase a 15-year, $25,000 mortgage bond with a 9% coupon, you would receive 15-year period, you would receive the par value of You: in interest each year, and at the end of the Friend: OK, and am I guaranteed to receive these interest payments and the par value? Bonds generally have associated with different levels of security. Mortgage bonds have that they associated risk than stocks do, but different types of bonds are standing, meaning You backed by a legal claim on some specific property Friend: Are there any other general features I should be aware of? Mortgage bonds are a type of government, but are not actually obligations of the U.S. Treasury. Another common feature of mortgage bonds is that they bond (by paying you back and ceasing to pay interest payments) at any point before the maturity date You: issued by political subdivisions of the U.S , meaning that the issuer can retire the Friend: So if the interest rate were to fall and the issuer were able to retire my bond, I would be issuer returns to me, I would receive a Exactly. In such a case, the issuer would pay you a than if I were to continue holding the bond, because if I reinvest the money the interest rate You: , but this generally would not fully compensate you for your loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts