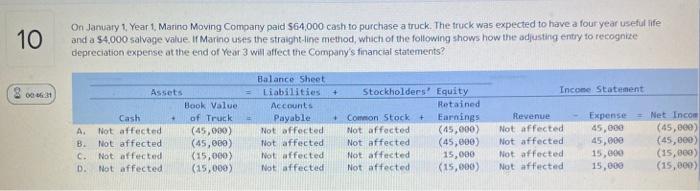

Question: Answer options Option A Option B Option C Option D 10 On January 1 Year 1, Marino Moving Company paid $64.000 cash to purchase a

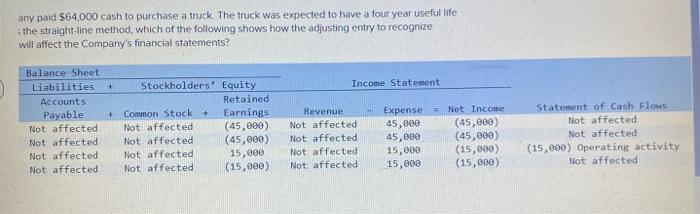

10 On January 1 Year 1, Marino Moving Company paid $64.000 cash to purchase a truck. The truck was expected to have a four year useful life and a $4.000 salvage value. If Marino uses the straight line method, which of the following shows how the adjusting entry to recognize depreciation expense at the end of Year 3 will affect the Company's financial statements? 800** + Income Statement - + Assets Book Value Cash of Truck A. Not affected (45,000) B. Not affected (45,000) C. Not affected (15,000) D. Not affected (15,000) Balance Sheet Liabilities Accounts Payable Not affected Not affected Not affected Not affected Stockholders' Equity Retained Common Stock + Earnings Not affected (45,000) Not affected (45,000) Not affected 15,000 Not affected (15,000 Revenue Not affected Not affected Not affected Not affected Expense = Net Incom 45,000 (45,000) 45,00 (45,000) 15,000 (15,000) 15,000 (15, 000) any paid $64,000 cash to purchase a truck. The truck was expected to have a four year useful life the straight-line method, which of the following shows how the adjusting entry to recognize will affect the Company's financial statements? + Income Statement + + Balance Sheet Liabilities Accounts Payable Not affected Not affected Not affected Not affected Stockholders' Equity Retained Common Stock Earnings Not affected (45,000) Not affected (45,000) Not affected 15,000 Not affected (15,000) Revenue Not affected Not affected Not affected Not affected Expense Net Income 45,000 (45,000) 45,000 (45,000) 15,000 (15,000) 15,000 (15,680) Statement of Cash Flows Not affected Not affected (15,000) Operating activity Not affected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts