Question: Answer Part 2 correctly or be subject to a thumbs down. If you don't know the answer 100% please don't answer. Intro A bank is

Answer Part 2 correctly or be subject to a thumbs down. If you don't know the answer 100% please don't answer.

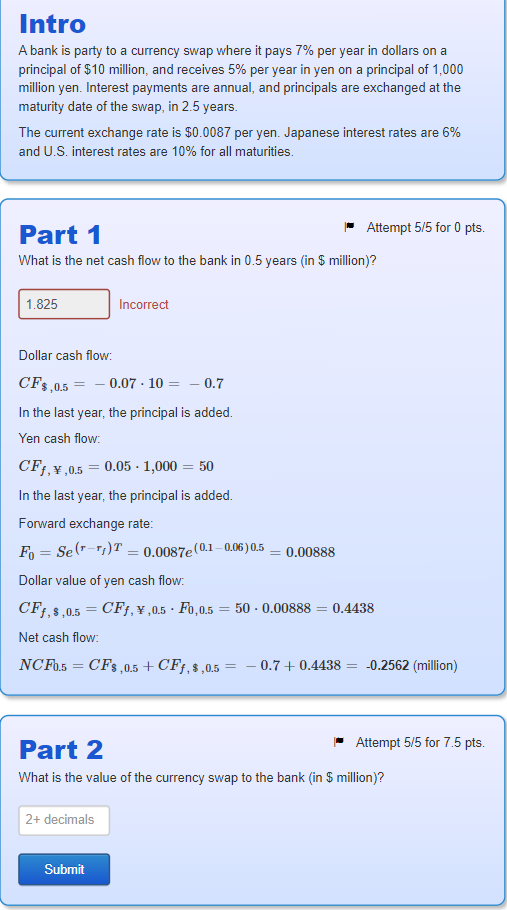

Intro A bank is party to a currency swap where it pays 7% per year in dollars on a principal of $10 million, and receives 5% per year in yen on a principal of 1,000 million yen. Interest payments are annual, and principals are exchanged at the maturity date of the swap, in 2.5 years. The current exchange rate is $0.0087 per yen. Japanese interest rates are 6% and U.S. interest rates are 10% for all maturities. Part 1 Attempt 5/5 for 0 pts What is the net cash flow to the bank in 0.5 years (in $ million)? Incorrect Dollar cash flow: CF$,0.5=0.0710=0.7 In the last year, the principal is added. Yen cash flow: CFf,,0.5=0.051,000=50 In the last year, the principal is added. Forward exchange rate: F0=Se(rrf)T=0.0087e(0.10.06)0.5=0.00888 Dollar value of yen cash flow: CFf,&,0.5=CFf,,0.5F0,0.5=500.00888=0.4438 Net cash flow: NCF0.5=CF,0.5+CFf,$,0.5=0.7+0.4438=0.2562(million) Part 2 - Attempt 5/5 for 7.5 pts. What is the value of the currency swap to the bank (in $ million)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts