Question: ANSWER PART A PLEASE Consider a market with a risk-free security and a risky asset. Assume that investor is not a price-taker so that her

ANSWER PART A PLEASE

ANSWER PART A PLEASE

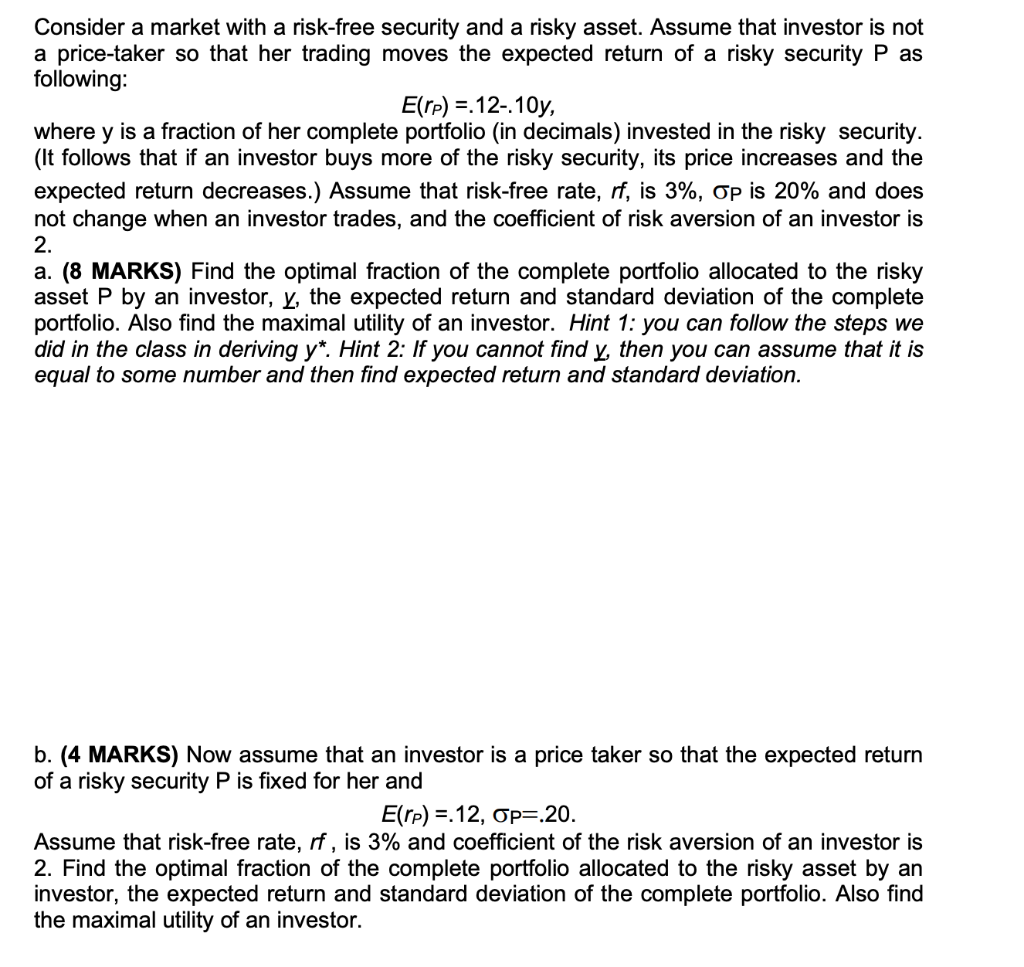

Consider a market with a risk-free security and a risky asset. Assume that investor is not a price-taker so that her trading moves the expected return of a risky security P as following: E(rp) =.12-.10y, where y is a fraction of her complete portfolio (in decimals) invested in the risky security. (It follows that if an investor buys more of the risky security, its price increases and the expected return decreases.) Assume that risk-free rate, rf, is 3%, OP is 20% and does not change when an investor trades, and the coefficient of risk aversion of an investor is 2. a. (8 MARKS) Find the optimal fraction of the complete portfolio allocated to the risky asset P by an investor, y, the expected return and standard deviation of the complete portfolio. Also find the maximal utility of an investor. Hint 1: you can follow the steps we did in the class in deriving y*. Hint 2: If you cannot find y, then you can assume that it is equal to some number and then find expected return and standard deviation. b. (4 MARKS) Now assume that an investor is a price taker so that the expected return of a risky security P is fixed for her and E(rp) =.12, Op.20. Assume that risk-free rate, rf, is 3% and coefficient of the risk aversion of an investor is 2. Find the optimal fraction of the complete portfolio allocated to the risky asset by an investor, the expected return and standard deviation of the complete portfolio. Also find the maximal utility of an investor. Consider a market with a risk-free security and a risky asset. Assume that investor is not a price-taker so that her trading moves the expected return of a risky security P as following: E(rp) =.12-.10y, where y is a fraction of her complete portfolio (in decimals) invested in the risky security. (It follows that if an investor buys more of the risky security, its price increases and the expected return decreases.) Assume that risk-free rate, rf, is 3%, OP is 20% and does not change when an investor trades, and the coefficient of risk aversion of an investor is 2. a. (8 MARKS) Find the optimal fraction of the complete portfolio allocated to the risky asset P by an investor, y, the expected return and standard deviation of the complete portfolio. Also find the maximal utility of an investor. Hint 1: you can follow the steps we did in the class in deriving y*. Hint 2: If you cannot find y, then you can assume that it is equal to some number and then find expected return and standard deviation. b. (4 MARKS) Now assume that an investor is a price taker so that the expected return of a risky security P is fixed for her and E(rp) =.12, Op.20. Assume that risk-free rate, rf, is 3% and coefficient of the risk aversion of an investor is 2. Find the optimal fraction of the complete portfolio allocated to the risky asset by an investor, the expected return and standard deviation of the complete portfolio. Also find the maximal utility of an investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts