Question: ANSWER PART D!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! ANSWER ALL IF YOU NEED ALL TO SOLVE PLEASEEEEE ONLY ANSWER PART D Question 2 Suppose that a fund that tracks the

ANSWER PART D!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! ANSWER ALL IF YOU NEED ALL TO SOLVE PLEASEEEEE

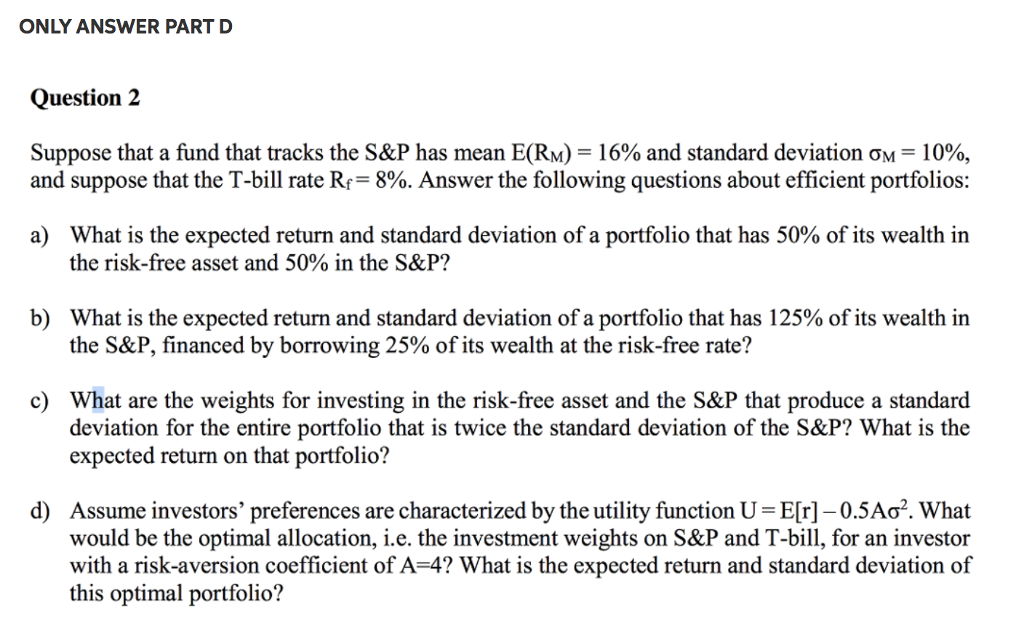

ONLY ANSWER PART D Question 2 Suppose that a fund that tracks the S&P has mean E(RM) 16% and standard deviation oM- 10%, and suppose that the T-bill rate Rf 8%. Answer the following questions about efficient portfolios a) What is the expected return and standard deviation of a portfolio that has 50% of its wealth in the risk-free asset and 50% in the S&P? b) What is the expected return and standard deviation of a portfolio that has 125% of its wealth in the S&P, financed by borrowing 25% of its wealth at the risk-free rate? c) What are the weights for investing in the risk-free asset and the S&P that produce a standard deviation for the entire portfolio that is twice the standard deviation of the S&P? What is the expected return on that portfolio? d) Assume investors' preferences are characterized by the utility function U JECr-0.5Ao2. What would be the optimal allocation, i e. the investment weights on S&P and T-bill, for an investor with a risk-aversion coefficient of A-4? What is the expected return and standard deviation of this optimal portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts