Question: Answer please ! 23 RCA Imt De Dhe dedant True - The True OF Orale sport Fate True false 151 Soros for any oth The

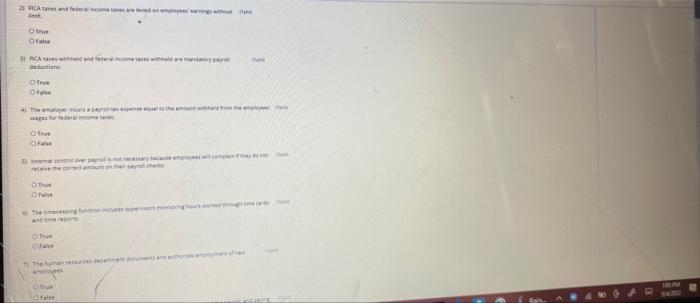

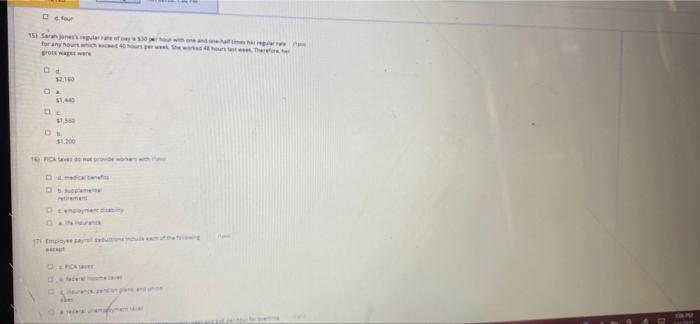

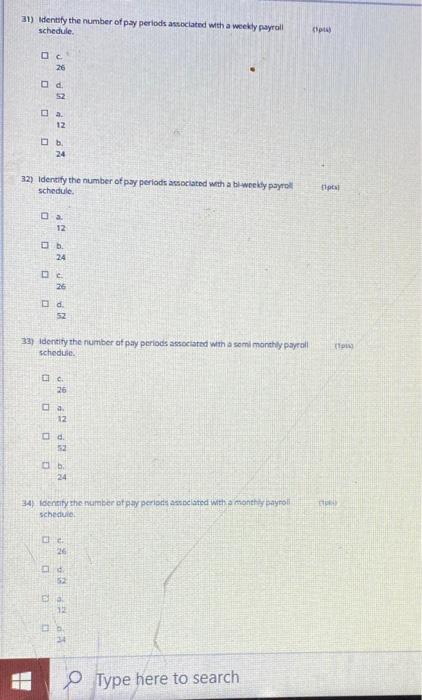

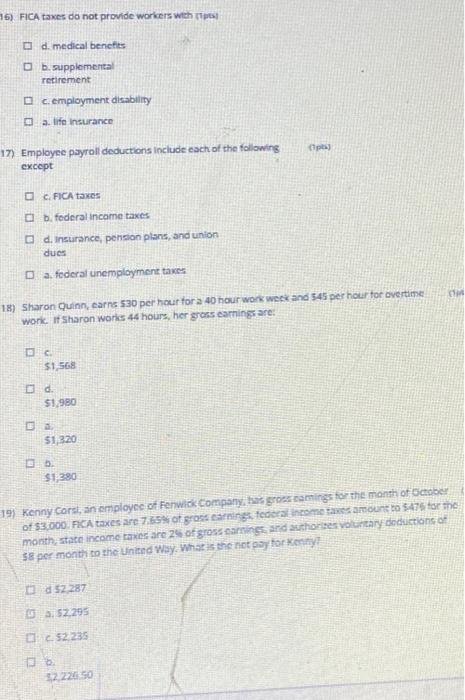

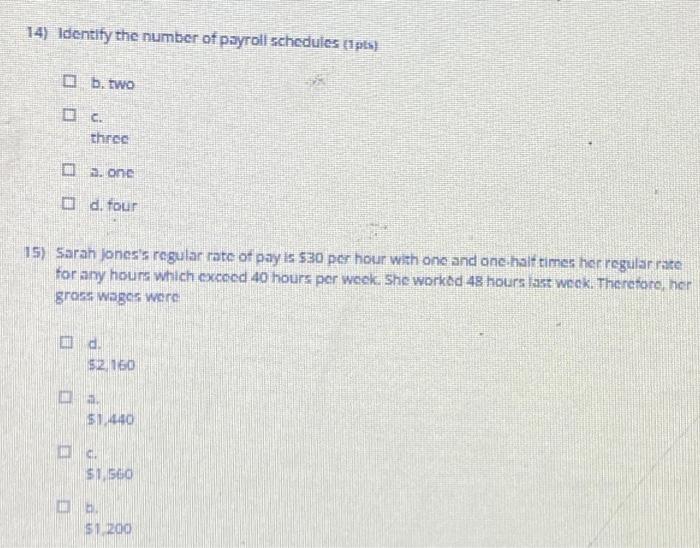

23 RCA Imt De Dhe dedant True - The True OF Orale sport Fate True false 151 Soros for any oth The 11 1156 De 31) Identity the number of pay periods associated with a weekly payroll schedule. . 26 Do a. 12 24 32) Identify the number of pay periods associated with a biweekly payroll schedule. pal a. 12 0 0 0 0 b. 24 26 Dd 52 33) Identify the number of pay periods associated with a semi monthly payroll schedule 26 0 0 D a. 12 d. Ob 24 34) Identity the number of pay periods associated with a month payroll Schedule 26 DO d 52 a 13 13 Type here to search 15) FICA taxes do not provide workers with the d. medical benefits b. supplemental retirement c.employment disability a life insurance cp) 17) Employee payroll deductions include each of the following except O FICA taxes b. federal income taxes d. Insurance, pension plans, and union due a. federal unemployment takes 18) Sharon Quinn, carns 530 per hour fora 40 hour work wees and 545 per hour to overtime work of Sharon works 44 hours, her gross earnings are: $1,568 3 d. $1,980 a $1,320 b. $1380 19) Kenny Cors, an employee of Fenwick Company, las gros comings for the month of October of $3.000. PICA taxes are 7.65% of groteines federal income taxes amount to $475 for the month state income taxes are 25 of gross earnings and authorises voluntary deduction of 58 per month to the United Way What is the notasyon 52 287 52.295 52.235 5222650 14) Identify the number of payroll schedules b. two D C three 2. one de four 15) Sarah Jones's regular rate of pay is $30 per hour with one and one-half times herregularrate for any hours which excoed 40 hours per week. She worked 48 hours last week. Therefore, her gross wagos were d 52160 $1,440 INC $1.500 $1.200 23 RCA Imt De Dhe dedant True - The True OF Orale sport Fate True false 151 Soros for any oth The 11 1156 De 31) Identity the number of pay periods associated with a weekly payroll schedule. . 26 Do a. 12 24 32) Identify the number of pay periods associated with a biweekly payroll schedule. pal a. 12 0 0 0 0 b. 24 26 Dd 52 33) Identify the number of pay periods associated with a semi monthly payroll schedule 26 0 0 D a. 12 d. Ob 24 34) Identity the number of pay periods associated with a month payroll Schedule 26 DO d 52 a 13 13 Type here to search 15) FICA taxes do not provide workers with the d. medical benefits b. supplemental retirement c.employment disability a life insurance cp) 17) Employee payroll deductions include each of the following except O FICA taxes b. federal income taxes d. Insurance, pension plans, and union due a. federal unemployment takes 18) Sharon Quinn, carns 530 per hour fora 40 hour work wees and 545 per hour to overtime work of Sharon works 44 hours, her gross earnings are: $1,568 3 d. $1,980 a $1,320 b. $1380 19) Kenny Cors, an employee of Fenwick Company, las gros comings for the month of October of $3.000. PICA taxes are 7.65% of groteines federal income taxes amount to $475 for the month state income taxes are 25 of gross earnings and authorises voluntary deduction of 58 per month to the United Way What is the notasyon 52 287 52.295 52.235 5222650 14) Identify the number of payroll schedules b. two D C three 2. one de four 15) Sarah Jones's regular rate of pay is $30 per hour with one and one-half times herregularrate for any hours which excoed 40 hours per week. She worked 48 hours last week. Therefore, her gross wagos were d 52160 $1,440 INC $1.500 $1.200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts