Question: answer please ASAP .. i want the final answer only A company purchased factory equipment for $700,000. It is estimated that the equipment will have

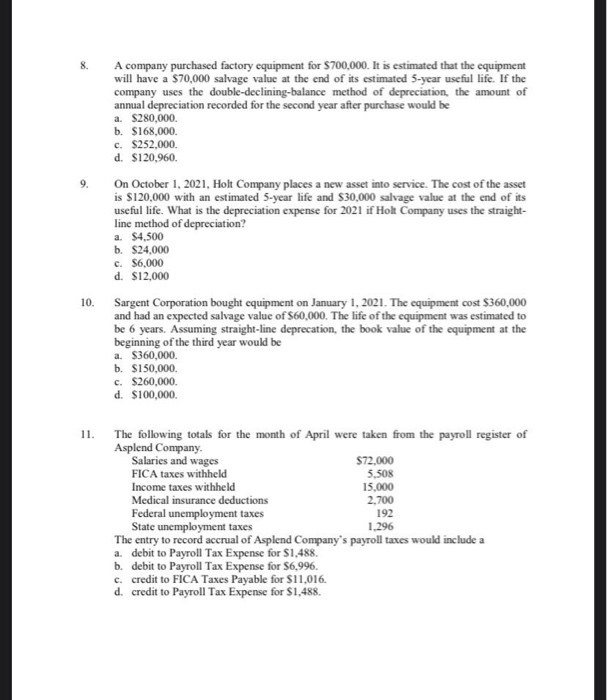

A company purchased factory equipment for $700,000. It is estimated that the equipment will have a $70,000 salvage value at the end of its estimated 5-year useful life. If the company uses the double-declining-balance method of depreciation, the amount of annual depreciation recorded for the second year after purchase would be a. $280,000. b. $168,000 c. $252,000 d. $120.960. On October 1, 2021. Holt Company places a new asset into service. The cost of the asset is $120,000 with an estimated 5-year life and $30,000 salvage value at the end of its useful life. What is the depreciation expense for 2021 if Holt Company uses the straight- line method of depreciation? a $4,500 b. $24,000 c. $6.000 d. $12.000 10. Sargent Corporation bought equipment on January 1, 2021. The equipment cost $360,000 and had an expected salvage value of $60,000. The life of the equipment was estimated to be 6 years. Assuming straight-line deprecation, the book value of the equipment at the beginning of the third year would be a. $360,000. b. $150,000. c. $260,000. d. $100,000 The following totals for the month of April were taken from the payroll register of Asplend Company Salaries and wages $72.000 FICA taxes withheld 5.508 Income taxes withheld 15,000 Medical insurance deductions 2.700 Federal unemployment taxes 192 State unemployment taxes 1.296 The entry to record accrual of Asplend Company's payroll taxes would include a a. debit to Payroll Tax Expense for $1.488. b. debit to Payroll Tax Expense for $6.996. c. credit to FICA Taxes Payable for $11.016. d. credit to Payroll Tax Expense for $1.488

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts