Question: Answer please Problem 7-37 (LO. 7) Wesley, who is single, listed his personal residence with a real estate agent on March 3, 2021, at a

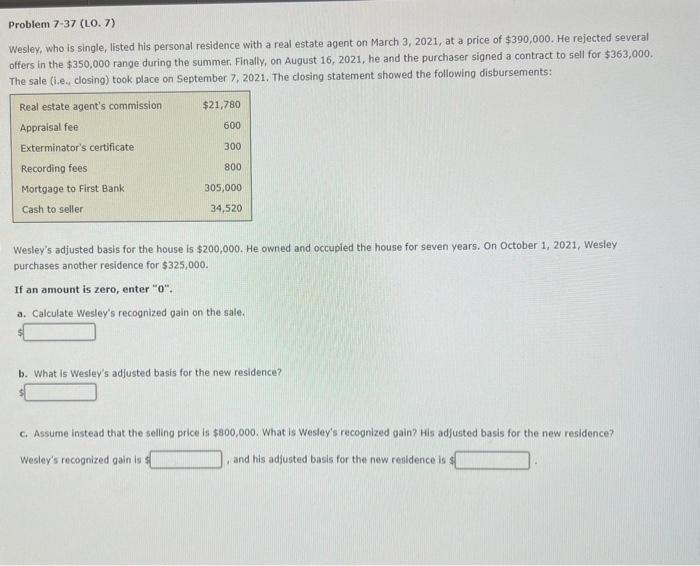

Problem 7-37 (LO. 7) Wesley, who is single, listed his personal residence with a real estate agent on March 3, 2021, at a price of $390,000. He rejected several offers in the $350,000 range during the summer. Finally, on August 16,2021 , he and the purchaser signed a contract to sell for $363,000. The sale (i.e. closing) took place on September 7, 2021. The dosing statement showed the following disbursements: Wesley's adjusted basis for the house is $200,000. He owned and occupied the house for seven years. On October 1, 2021, Wesley purchases another residence for $325,000. If an amount is zero, enter " 0 ". a. Calculate Wesley's recognized gain on the sale. b. What is Wesley's adjusted basis for the new residence? c. Assume instead that the selling price is $800,000. What is Wesley's recognized gain? His adjusted basis for the new residence? Wesley's recognized gain is : and his adjusted basis for the new residence is 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts