Question: Answer please Q1 CoursHeroTranscribedText: Replacement Decision, Computing After-Tax Cash Flows, Basie NP'U Analysis Okmulgee Hospital {a large metropolitan for-prot hospital) is considering replacing its MRI

Answer please

Q1

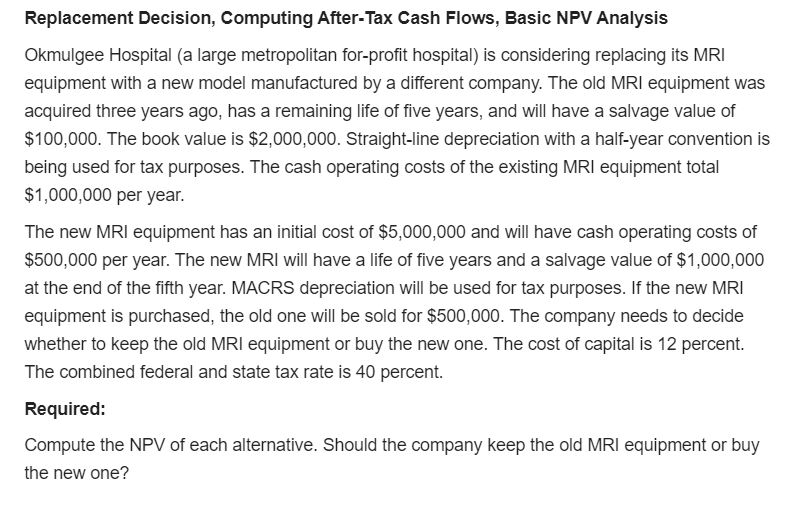

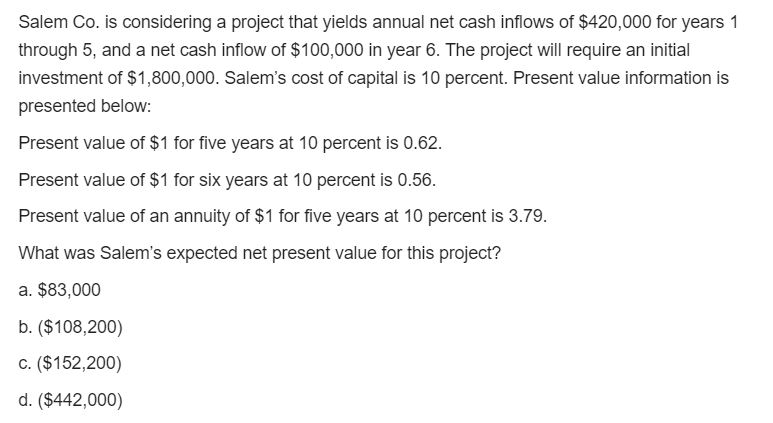

CoursHeroTranscribedText: Replacement Decision, Computing After-Tax Cash Flows, Basie NP'U Analysis Okmulgee Hospital {a large metropolitan for-prot hospital) is considering replacing its MRI equipment with a new model manufactured by a different company. The old MRi equipment was acquired three years ago, has a remaining life of ve years, and will have a salvage value of $100,000. The book value is $2,000,000. Straight-line depreciation with a half-year convention is being used for tax purposes. The cash operating costs of the existing MRI equipment total $1,000,000 per year. The new MRI equipment has an initial cost of $5,000,000 and will have cash operating costs of $500,000 per year. The new llel will have a life of ve years and a salvage value of $1,000,000 at the end of the fth year. MAGRS depreciation will be used for tax purposes. if the new MRi equipment is purchased, the old one will be sold for $500,000. The company needs to decide whether to keep the old MRI equipment or buy the new one. The cost of capital is 12 percent. The combined federal and state tax rate is 40 percent. Required: Compute the NPV of each alternative. Should the company keep the old MRI equipment or buy the new one? Salem Go. is considering a protect that yields annual net cash inows of $42D,DEID for years 1 through 5, and a net cash inow of $1 09,000 in year 6. The prciecl will require an initial investment of $1 ll-3,001]. Salem's cost of capital is 10 percent. Present value information is presented below: Present value of $1 for ve years at 1!] percent is I152. Present value of $1 for six years at 10 percent is 0.56. Present value of an annuity of $1 for ve years at 10 percent is 3.?9. What was Salem's expected net present value for this project? a. $83,l.'l b. {$1cs,2cc} c. {$152,200} d. {$442,0cc}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts