Question: Answer please. Question 2 A. DHEL Corporation issues a 7% coupon interest rate bond with a maturity of 20 years. The face value of the

Answer please.

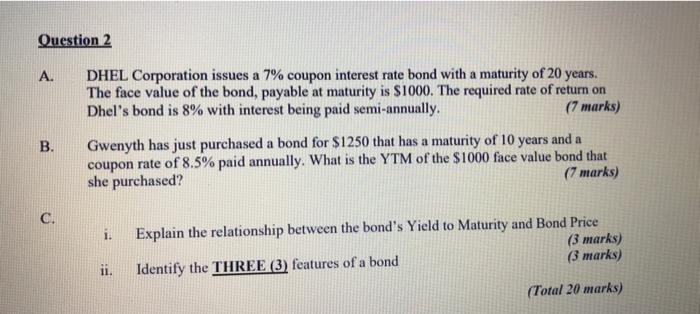

Question 2 A. DHEL Corporation issues a 7% coupon interest rate bond with a maturity of 20 years. The face value of the bond, payable at maturity is $1000. The required rate of return on Dhel's bond is 8% with interest being paid semi-annually. (7 marks) B. Gwenyth has just purchased a bond for $1250 that has a maturity of 10 years and a coupon rate of 8.5% paid annually. What is the YTM of the $1000 face value bond that she purchased? (7 marks) C. 1. Explain the relationship between the bond's Yield to Maturity and Bond Price (3 marks) Identify the THREE (3) features of a bond (3 marks) ii. (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock