Question: Answer please!! Question Completion Status: Please use the following information to determine the financial metrics listed to complete the financial analysis of this company: INCOME

Answer please!!

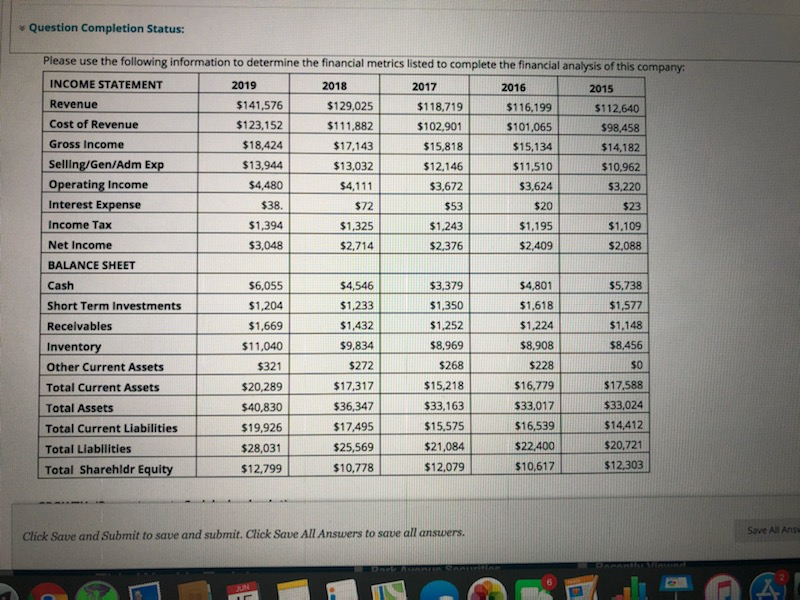

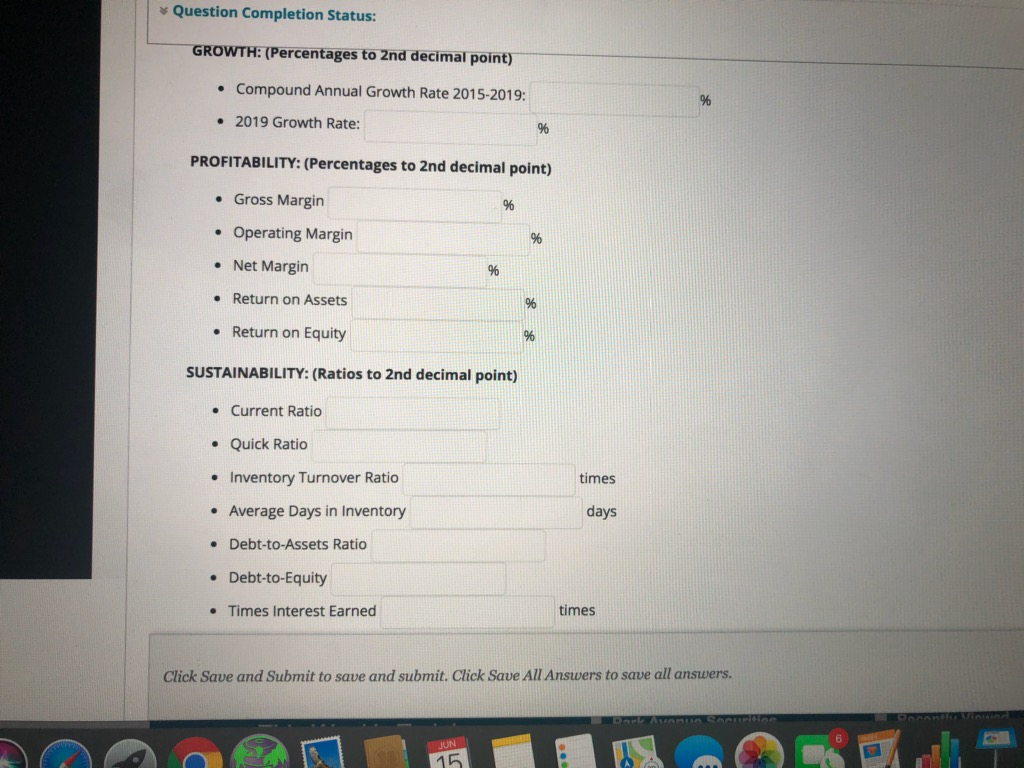

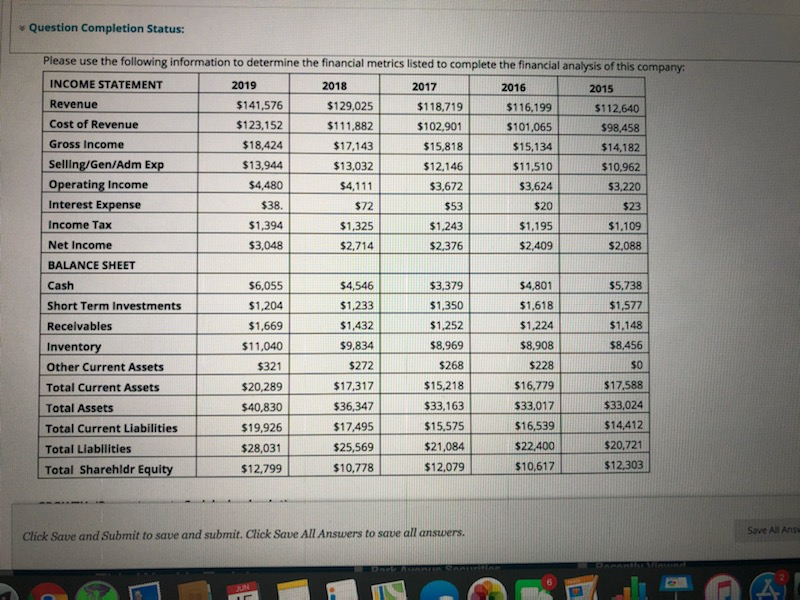

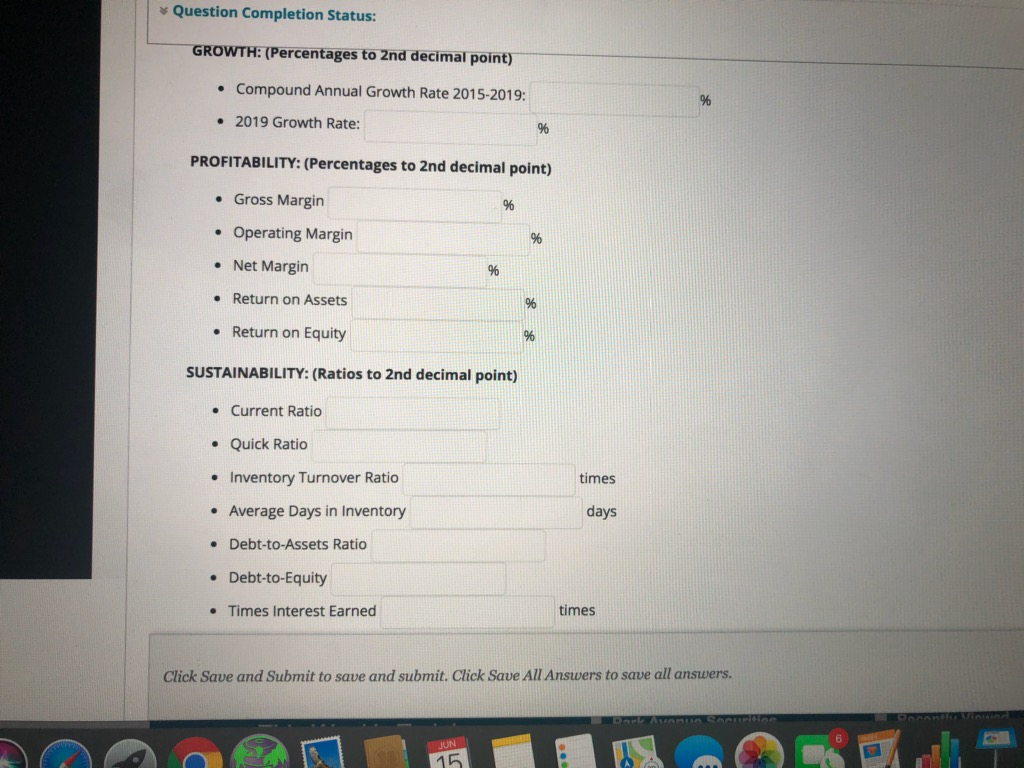

Question Completion Status: Please use the following information to determine the financial metrics listed to complete the financial analysis of this company: INCOME STATEMENT 2019 2018 2017 2016 2015 Revenue $141,576 $129,025 $118,719 $116,199 $112,640 Cost of Revenue $123,152 $111,882 $102,901 $101,065 $98.458 Gross Income $18.424 $17,143 $15,818 $15,134 $14,182 Selling/Gen/Adm Exp $13.944 $13,032 $12.146 $11,510 $10,962 Operating Income $4,480 $4,111 $3,672 $3,624 $3,220 Interest Expense $38. $72 $53 $20 $23 Income Tax $1,394 $1,325 $1,243 $1,195 $1,109 Net Income $3,048 $2,714 $2,376 $2,409 $2,088 BALANCE SHEET Cash $6,055 $4,546 $3,379 $4,801 $5,738 Short Term Investments $1,204 $1,233 $1,350 $1,618 $1,577 Receivables $1,669 $1,432 $1,252 $1,224 $1,148 Inventory $11,040 $9,834 $8,969 $8.908 $8,456 Other Current Assets $321 $272 $268 $228 $0 Total Current Assets $20,289 $17,317 $15,218 $16.779 $17.588 Total Assets $40,830 $36,347 $33,163 $33,017 $33,024 Total Current Liabilities $19.926 $17,495 $15.575 $16,539 $14,412 Total Liabilities $28,031 $25,569 $21,084 $22.400 $20,721 Total Sharehldr Equity $12.799 $10,778 $12,079 $10,617 $12,303 Save All Ans Click Save and Submit to save and submit. Click Save All Answers to save all answers. UN Question Completion Status: GROWTH: (Percentages to 2nd decimal point) Compound Annual Growth Rate 2015-2019: % 2019 Growth Rate: % PROFITABILITY: (Percentages to 2nd decimal point) Gross Margin % Operating Margin % Net Margin % Return on Assets Return on Equity SUSTAINABILITY:(Ratios to 2nd decimal point) Current Ratio Quick Ratio Inventory Turnover Ratio times Average Days in Inventory days Debt-to-Assets Ratio Debt-to-Equity Times Interest Earned times Click Save and Submit to save and submit. Click Save All Answers to save all answers. JUN 15 Question Completion Status: Please use the following information to determine the financial metrics listed to complete the financial analysis of this company: INCOME STATEMENT 2019 2018 2017 2016 2015 Revenue $141,576 $129,025 $118,719 $116,199 $112,640 Cost of Revenue $123,152 $111,882 $102,901 $101,065 $98.458 Gross Income $18.424 $17,143 $15,818 $15,134 $14,182 Selling/Gen/Adm Exp $13.944 $13,032 $12.146 $11,510 $10,962 Operating Income $4,480 $4,111 $3,672 $3,624 $3,220 Interest Expense $38. $72 $53 $20 $23 Income Tax $1,394 $1,325 $1,243 $1,195 $1,109 Net Income $3,048 $2,714 $2,376 $2,409 $2,088 BALANCE SHEET Cash $6,055 $4,546 $3,379 $4,801 $5,738 Short Term Investments $1,204 $1,233 $1,350 $1,618 $1,577 Receivables $1,669 $1,432 $1,252 $1,224 $1,148 Inventory $11,040 $9,834 $8,969 $8.908 $8,456 Other Current Assets $321 $272 $268 $228 $0 Total Current Assets $20,289 $17,317 $15,218 $16.779 $17.588 Total Assets $40,830 $36,347 $33,163 $33,017 $33,024 Total Current Liabilities $19.926 $17,495 $15.575 $16,539 $14,412 Total Liabilities $28,031 $25,569 $21,084 $22.400 $20,721 Total Sharehldr Equity $12.799 $10,778 $12,079 $10,617 $12,303 Save All Ans Click Save and Submit to save and submit. Click Save All Answers to save all answers. UN Question Completion Status: GROWTH: (Percentages to 2nd decimal point) Compound Annual Growth Rate 2015-2019: % 2019 Growth Rate: % PROFITABILITY: (Percentages to 2nd decimal point) Gross Margin % Operating Margin % Net Margin % Return on Assets Return on Equity SUSTAINABILITY:(Ratios to 2nd decimal point) Current Ratio Quick Ratio Inventory Turnover Ratio times Average Days in Inventory days Debt-to-Assets Ratio Debt-to-Equity Times Interest Earned times Click Save and Submit to save and submit. Click Save All Answers to save all answers. JUN 15