Question: answer pls as soon as possible Question 3 [10 points) On October 1, 2014 XYZ Corporation borrowed $552,000 by signing a four-year installment note bearing

answer pls as soon as possible

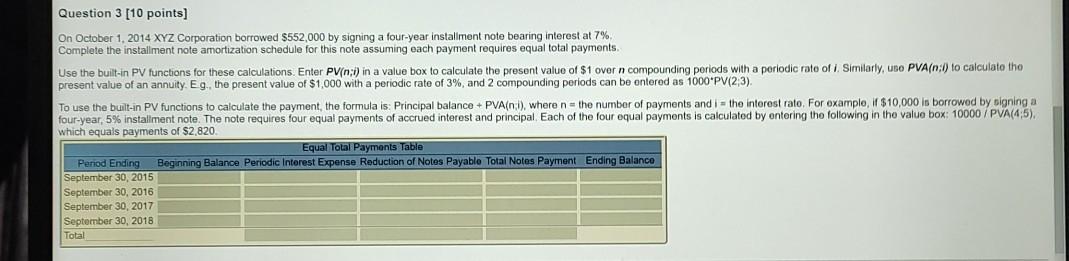

Question 3 [10 points) On October 1, 2014 XYZ Corporation borrowed $552,000 by signing a four-year installment note bearing interest at 7% Complete the installment note amortization schedule for this note assuming each payment requires equal total payments. Use the built-in PV functions for these calculations. Enter PV(n:1) in a value box to calculate the present value of $1 overn compounding periods with a periodic rate of Similarly, uso PVA(nl) to calculate the present value of an annuity. Eg, the present value of $1,000 with a periodic rate of 3%, and 2 compounding poriods can be onlerod as 1000'PV(23) To use the built-in PV functions to calculate the payment, the formula is: Principal balance + PVA(n:1), where n = the number of payments and i = the interest rato. For example, if $10,000 is borrowed by signing a four-year, 5% installment note. The note requires four equal payments of accrued interest and principal Each of the four equal payments is calculated by entering the following in the value box: 10000 / PVA(4:5). which equals payments of $2,820 Equal Total Payments Table Period Ending Beginning Balance Periodic Interest Expense Reduction of Notes Payablo Total Notes Payment Ending Balance September 30, 2015 September 30, 2016 September 30, 2017 September 30, 2018 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts