Question: Answer Plz 2. Find r: You have $2,000 in a money market account. If you make no deposits to or withdrawals from this account, in

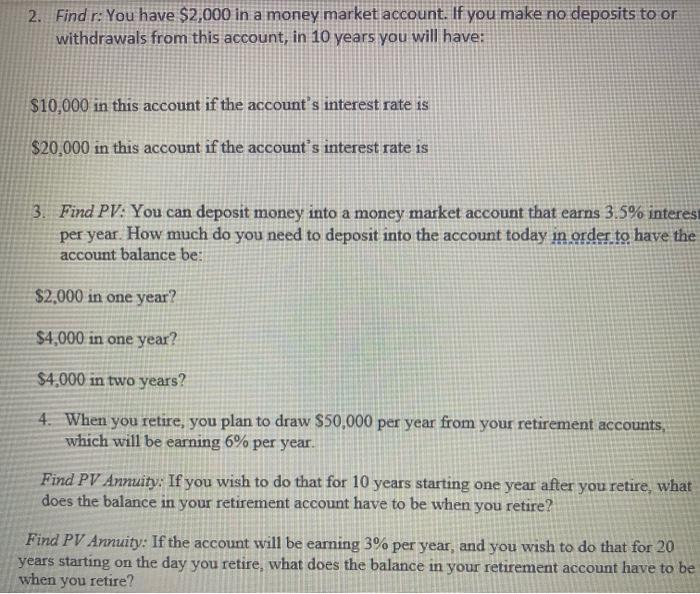

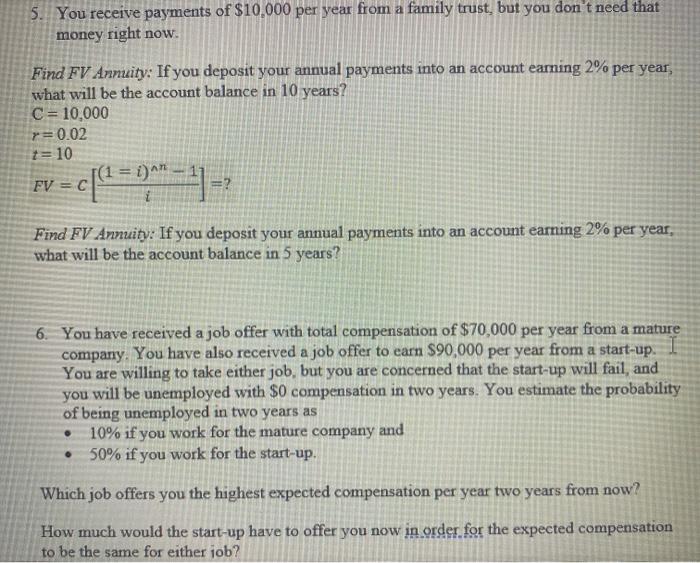

2. Find r: You have $2,000 in a money market account. If you make no deposits to or withdrawals from this account, in 10 years you will have: $10,000 in this account if the account's interest rate is $20,000 in this account if the account's interest rate is 3. Find PV: You can deposit money into a money market account that earns 3.5% interes per year. How much do you need to deposit into the account today in order to have the account balance be: $2,000 in one year? $4,000 in one year? $4.000 in two years? 4. When you retire, you plan to draw $50,000 per year from your retirement accounts, which will be earning 6% per year. Find PV Annuity: If you wish to do that for 10 years starting one year after you retire, what does the balance in your retirement account have to be when you retire? Find PV Annuity: If the account will be earning 3% per year, and you wish to do that for 20 years starting on the day you retire, what does the balance in your retirement account have to be 5. You receive payments of $10,000 per year from a family trust, but you don t need that money right now. Find FV Anmuity: If you deposit your annual payments into an account earning 2% per year, what will be the account balance in 10 years? C=10,000r=0.02t=10FV=C[i(1i)n1]=? Find FV Annuity: If you deposit your annual payments into an account earning 2% per year, what will be the account balance in 5 years? 6. You have received a job offer with total compensation of $70,000 per year from a mature company. You have also received a job offer to earn $90,000 per year from a start-up. I You are willing to take either job, but you are concerned that the start-up will fail, and you will be unemployed with $0 compensation in two years. You estimate the probability of being unemployed in two years as - 10% if you work for the mature company and - 50% if you work for the start-up. Which job offers you the highest expected compensation per year two years from now? How much would the start-up have to offer you now in order for the expected compensation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts