Question: answer plz 36. In 2010, HD had reported a deferred tax asset of $90 million with no valuation allowance. At December 31, 2011, the account

answer plz

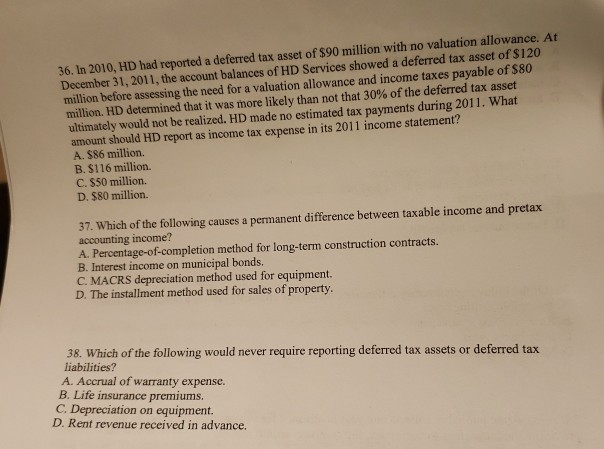

36. In 2010, HD had reported a deferred tax asset of $90 million with no valuation allowance. At December 31, 2011, the account balances of HD Services showed a deferred tax asset of $120 million before assessing the need for a valuation allowance and income taxes payable of $80 million. HD determined that it was more likely than not that 30% of the deferred tax asset ultimately would not be realized. HD made no estimated tax payments during 2011. What amount should HD report as income tax expense in its 2011 income statement? A. $86 million. B. $116 million. C. S50 million. D. $80 million. 37. Which of the following causes a permanent difference between taxable income and pretax accounting income? A. Percentage-of-completion method for long-term construction contracts. B. Interest income on municipal bonds C. MACRS depreciation method used for equipment. D. The installment method used for sales of property. 38. Which of the following would never require reporting deferred tax assets or deferred tax liabilities? A. Accrual of warranty expense. B. Life insurance premiums. C. Depreciation on equipment. D. Rent revenue received in advance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts