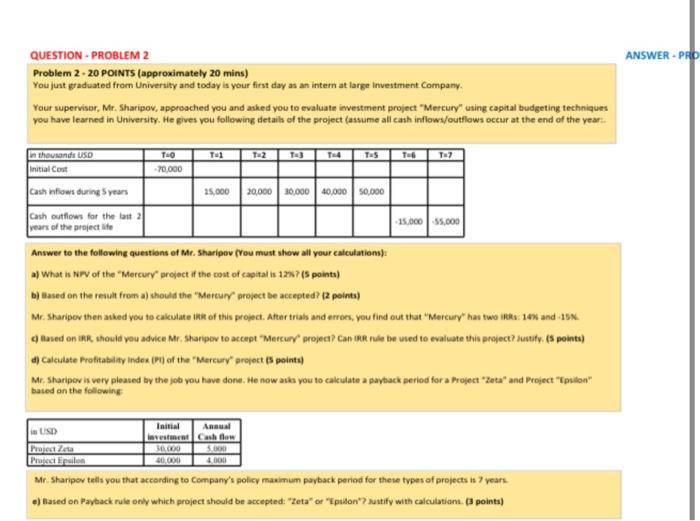

Question: ANSWER - PRO QUESTION - PROBLEM 2 Problem 2-20 POINTS (approximately 20 mins) You just graduated from University and today is your first day as

ANSWER - PRO QUESTION - PROBLEM 2 Problem 2-20 POINTS (approximately 20 mins) You just graduated from University and today is your first day as an intern at large investment Company, Your supervisor, Mr. Sharipov, approached you and asked you to evaluate investment project "Mercury" using capital budgeting techniques you have learned in University. He gives you following details of the project (assume all cash inflows/outflows occur at the end of the year.. T.1 T2 TAS T7 TO 70,000 15.000.000 In thousands USO Initial Cost cash ntions during 5 years 25,000 20,000 30,000 40,000 50,000 Cash outflows for the last 2 years of the projecte Answer to the following questions of Mr. Sharipov (vou must show all your calculations a) What is NPV of the "Mercury project of the cost of capital is 12%? (Spoints) b) Based on the result from a) should the "Mercury project be accepted? (2 points) Mr. Sharipov then asked you to calculate the of this project. Atter trials and erroes, you find out that "Mercury" has two ika: 104 and -15% tased on the should you advice Mr. Sharipov to accept "Mercury project? Can IRR rule be used to evaluate this project? sustity (5 points) Calculate profitability Index IP of the "Marcury project (3 points) Mr. Sharipov is very pleased by the job you have done. He now asks you to calculate a payback period for a Project Zeta" and Project "piton" based on the following Initial Annual investment Cashow Project 2 OU 3.000 Project Epulon 4.000 Mr. Sharipov tells you that according to Company's policy maximum payback period for these types of projects is 7 years .) Based on Payback rule only which project should be accepted: "Zeta" or "Iption" sustify with calculation points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts