Question: Answer problem 3 with complete solution PROPRIETARY EDUCATIONAL INSTITUTIONS EXERCISES 3. Assume that MGM School is a non-profit private educational institution with permit to operate

Answer problem 3 with complete solution

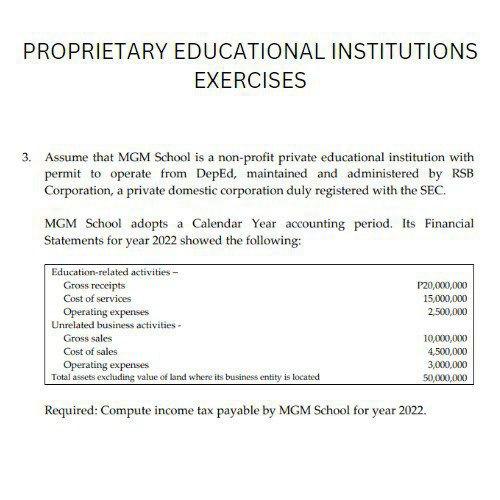

PROPRIETARY EDUCATIONAL INSTITUTIONS EXERCISES 3. Assume that MGM School is a non-profit private educational institution with permit to operate from DepEd, maintained and administered by RSB Corporation, a private domestic corporation duly registered with the SEC. MGM School adopts a Calendar Year accounting period. Its Financial Statements for year 2022 showed the following: Required: Compute income tax payable by MGM School for year 2022. PROPRIETARY EDUCATIONAL INSTITUTIONS EXERCISES 3. Assume that MGM School is a non-profit private educational institution with permit to operate from DepEd, maintained and administered by RSB Corporation, a private domestic corporation duly registered with the SEC. MGM School adopts a Calendar Year accounting period. Its Financial Statements for year 2022 showed the following: Required: Compute income tax payable by MGM School for year 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts