Question: Answer problem 5 ! prob 1 as reference Problem 5.0 cash flow timeline described in Problem i, and an expected return of 7% per year,

Answer problem 5 !

prob 1 as reference

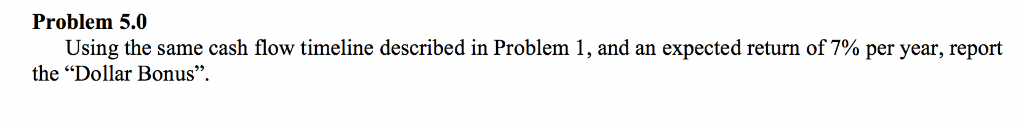

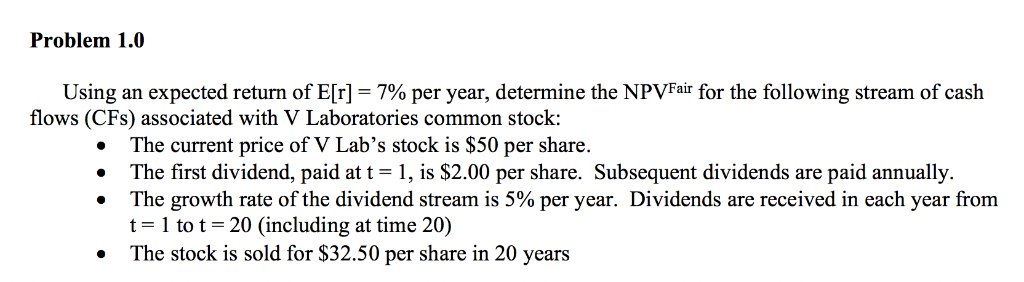

Problem 5.0 cash flow timeline described in Problem i, and an expected return of 7% per year, report 09 the "Dollar Bonus" Problem 1.0 Using an expected return of E[r]-7% per year, determine the NPVFar for the following stream of cash flows (CFs) associated with V Laboratories common stock: .The current price of V Lab's stock is $50 per share. .The first dividend, paid at t-1, is $2.00 per share. Subsequent dividends are paid annually. . The growth rate of the dividend stream is 5% per year. Dividends are received in each year from t-1 to t-20 (including at time 20) The stock is sold for $32.50 per share in 20 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts