Question: Answer problem and show work please 22. J&J Manufacturing is considering a project with the following cash flows. Calculate the payback period of the project.

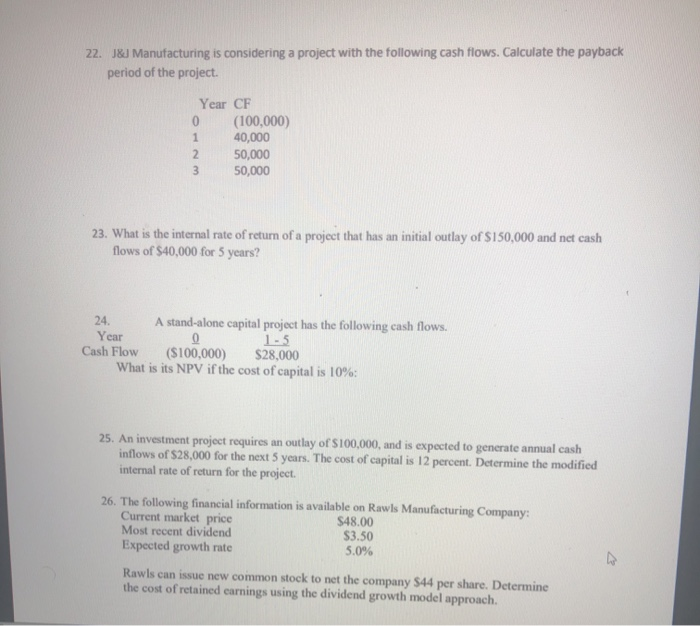

22. J&J Manufacturing is considering a project with the following cash flows. Calculate the payback period of the project. 1 Year CF (100,000) 40,000 2 50,000 3 50,000 23. What is the internal rate of return of a project that has an initial outlay of S150,000 and net cash flows of $40,000 for 5 years? 24. A stand-alone capital project has the following cash flows. Year 0 1 - 5 Cash Flow ($100,000) $28,000 What is its NPV if the cost of capital is 10% 25. An investment project requires an outlay of S100,000, and is expected to generate annual cash inflows of $28,000 for the next 5 years. The cost of capital is 12 percent. Determine the modified internal rate of return for the project. 26. The following financial information is available on Rawls Manufacturing Company: Current market price $48.00 Most recent dividend $3.50 Expected growth rate 5.0% Rawls can issue new common stock to net the company S44 per share. Determine the cost of retained carnings using the dividend growth model approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts