Question: answer provided, i need to know how to solve Forecasting: Use the information below to answer questions 1 to 5 The objective of this question

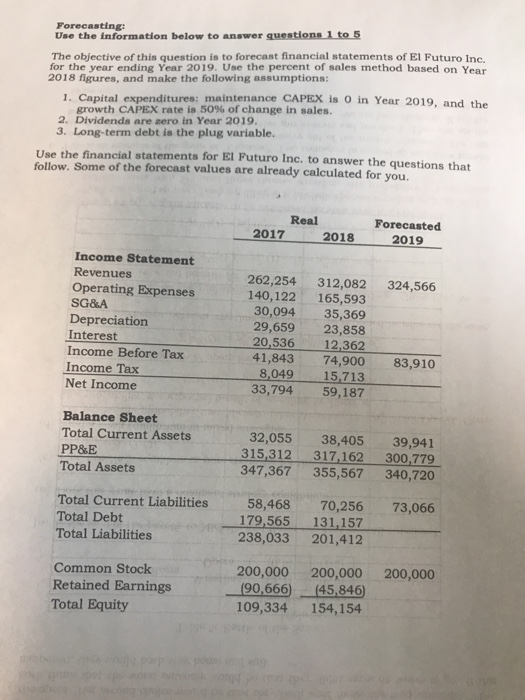

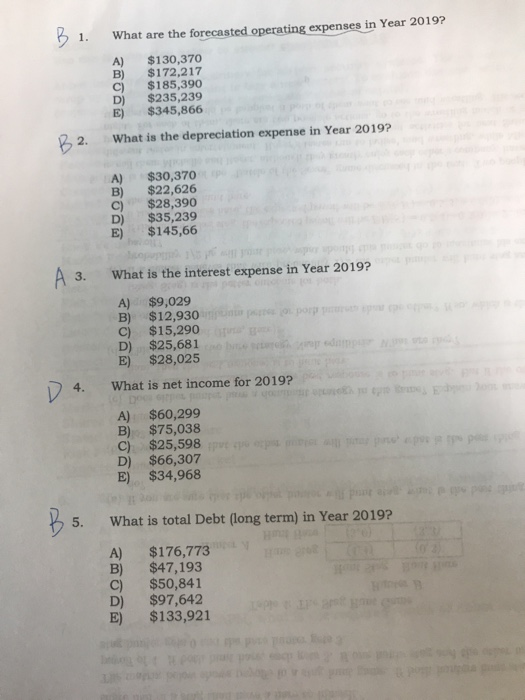

Forecasting: Use the information below to answer questions 1 to 5 The objective of this question is to forecast financial statements of El Futuro Inc. for the year ending Year 2019. Use the percent of sales method based on Year 2018 figures, and make the following assumptions: 1. Capital expenditures: maintenance CAPEX is O in Year 2019, and the growth CAPEX rate is 50% of change in sales. 2. Dividends are zero in Year 2019. 3. Long-term debt is the plug variable. Use the financial statements for El Futuro Inc. to answer the questions that follow. Some of the forecast values are already calculated for you. Real Forecasted 2019 2017 2018 Income Statement Revenues Operating Expenses SG&A Depreciation Interest Income Before Tax 262,254 312,082 324,566 140,122 165,593 30,094 35,369 29,659 23,858 20,536 12,362 41,843 74,900 83,910 8,049 15,713 Net Income33,794 59,187 Balance Sheet Total Current Assets PP&E Total Assets 32,055 38,405 39,941 315,312 317,162 300,779 347,367 355,567 340,720 Total Current Liabilities Total Debt Total Liabilities 58,468 70,256 73,066 179,565 131,157 238,033 201,412 Common Stock Retained Earnings Total Equity 200,000 200,000 200,000 666(45,846 190.6 109,334 154,154 1. What are the forecasted operating expenses in Year 2019? A) $130,370 B) $172,217 C $185,390 D) $235,239 E) $345,866 2. What is the depreciation expense in Year 2019 A) $30,370 B) $22,626 C) $28,390 D) $35,239 E) $145,66 A 3. What is the interest expense in Year 20192 A) $9,029 B) $12,930 C) $15,290 D) $25,681 E) $28,025 4. What is net income for 2019? A) $60,299 B) $75,038 C) $25,598 D) $66,307 E) $34,968 5. What is total Debt (long term) in Year 2019? A) $176,773 B) $47,193 C) $50,841 D) $97,642 E) $133,921

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts