Question: answer Q 20 plese A bond has 8 Years to maturity, a 7 percent coupon, a $1,000 face value, and pays interest semiannually. What is

answer Q 20 plese

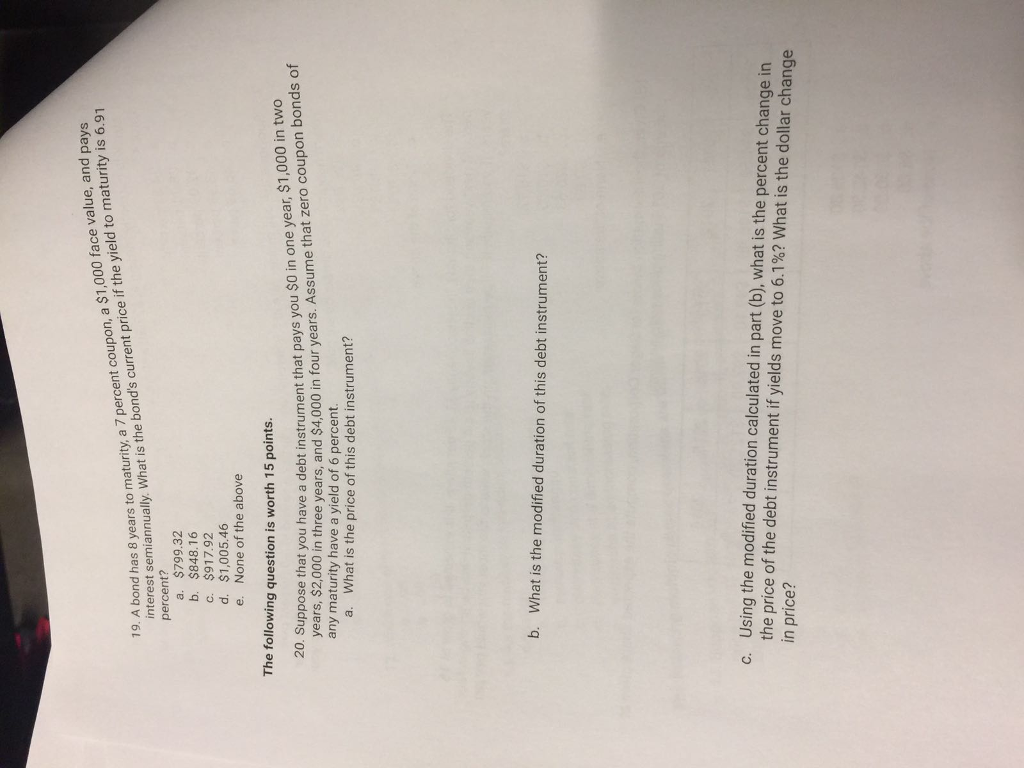

A bond has 8 Years to maturity, a 7 percent coupon, a $1,000 face value, and pays interest semiannually. What is the bond's current price if the yield to maturity is 6.91 percent? a. $799.32 b. $848.16 c. $917.92 d. $1,005.46 e. None of the above Suppose that you have a debt instrument that pays you so in one year, $1,000 in bonds of in and $4,000 in four years. Assume that zero coupon any maturity have a yield of 6 percent. a. What is the price of this debt instrument? b. What is the modified duration of this debt instrument? c. Using the modified duration calculated in part (b), what is the percent change in the price of the debt instrument if yields move to 6.1%? What is the dollar change in price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts