Question: Answer Q16 importantly! Question 15 1 pts Efficient Minds Capital Agressive Growth fund had an average return of 22.09%, a standard deviation of 17.27% and

Answer Q16 importantly!

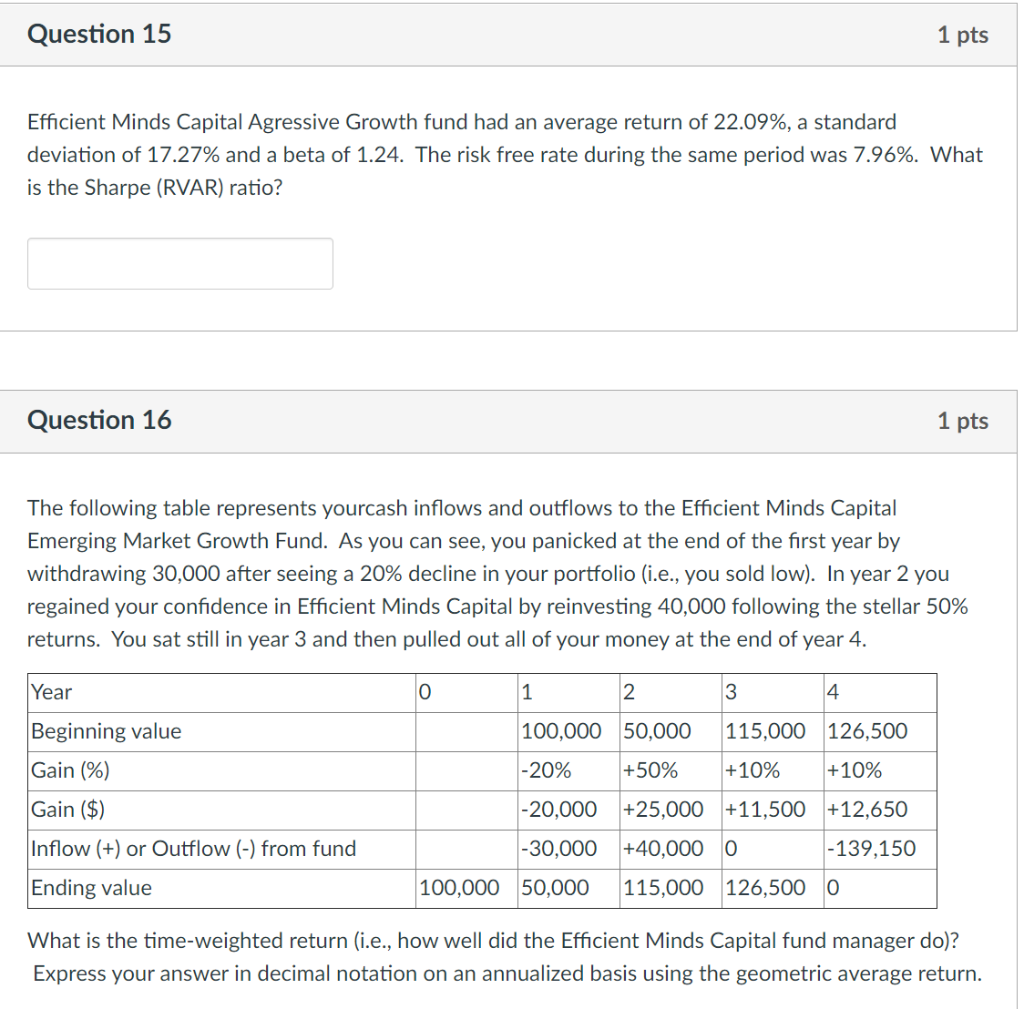

Question 15 1 pts Efficient Minds Capital Agressive Growth fund had an average return of 22.09%, a standard deviation of 17.27% and a beta of 1.24. The risk free rate during the same period was 7.96%. What is the Sharpe (RVAR) ratio? Question 16 1 pts The following table represents yourcash inflows and outflows to the Efficient Minds Capital Emerging Market Growth Fund. As you can see, you panicked at the end of the first year by withdrawing 30,000 after seeing a 20% decline in your portfolio (i.e., you sold low). In year 2 you regained your confidence in Efficient Minds Capital by reinvesting 40,000 following the stellar 50% returns. You sat still in year 3 and then pulled out all of your money at the end of year 4. Year o 1 2 3 4 100,000 50,000 115,000 126,500 Beginning value Gain (%) -20% +50% +10% +10% Gain ($) -20,000 +25,000 +11,500 +12,650 -30,000 +40,0000 - 139,150 Inflow (+) or Outflow (-) from fund Ending value 100,000 50,000 115,000 126,500 0 What is the time-weighted return (i.e., how well did the Efficient Minds Capital fund manager do)? Express your answer in decimal notation on an annualized basis using the geometric average return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts