Question: answer Q3 please 3. a) What is the adjusted beta if the raw beta of a firm is 0.5? (2.5 marks) b) Now is June

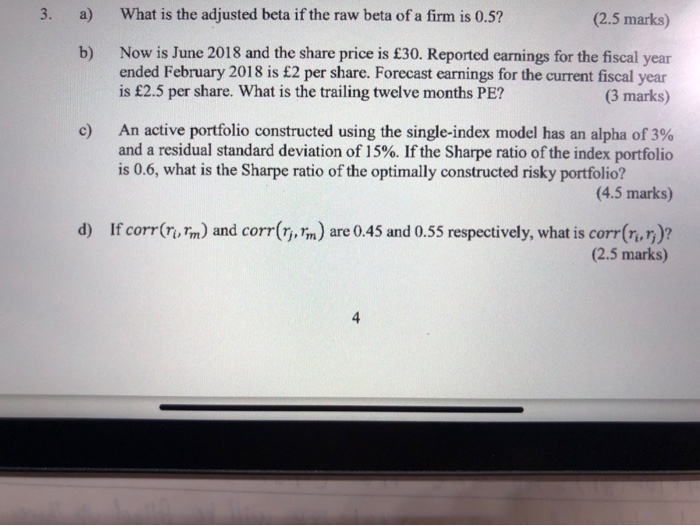

3. a) What is the adjusted beta if the raw beta of a firm is 0.5? (2.5 marks) b) Now is June 2018 and the share price is 30. Reported earnings for the fiscal year ended February 2018 is 2 per share. Forecast earnings for the current fiscal year is 2.5 per share. What is the trailing twelve months PE? (3 marks) An active portfolio constructed using the single-index model has an alpha of 3% and a residual standard deviation of 15%. If the Sharpe ratio of the index portfolio is 0.6, what is the Sharpe ratio of the optimally constructed risky portfolio? (4.5 marks) d) If corr(ri, rm) and corr(T;, rm) are 0.45 and 0.55 respectively, what is corr(rur;)? (2.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts