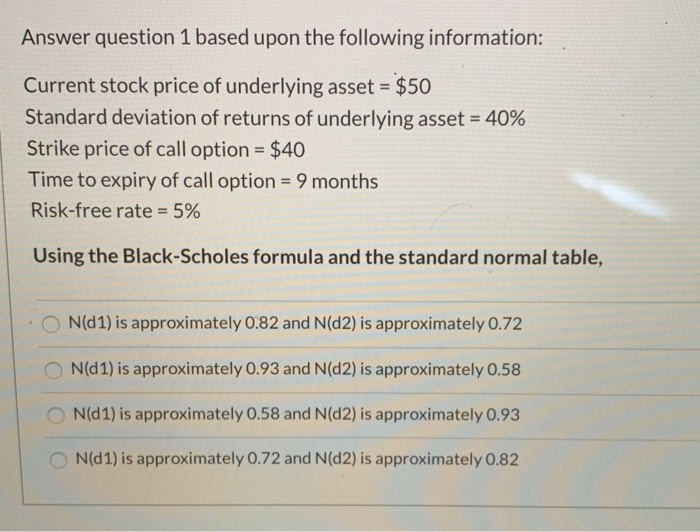

Question: Answer question 1 based upon the following information: Current stock price of underlying asset = $50 Standard deviation of returns of underlying asset = 40%

Answer question 1 based upon the following information: Current stock price of underlying asset = $50 Standard deviation of returns of underlying asset = 40% Strike price of call option = $40 Time to expiry of call option = 9 months Risk-free rate = 5% Using the Black-Scholes formula and the standard normal table, ON(D1) is approximately 0.82 and N(d2) is approximately 0.72 ON(D1) is approximately 0.93 and N(d2) is approximately 0.58 ON(d1) is approximately 0.58 and N(d2) is approximately 0.93 ON(D1) is approximately 0.72 and N(d) is approximately 0.82

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts