Question: answer question 18 use question 1 as reference Question 18 For the Orlando real estate investment problem, assume the probabilities for the gasoline shortage, stable

answer question 18 use question 1 as reference

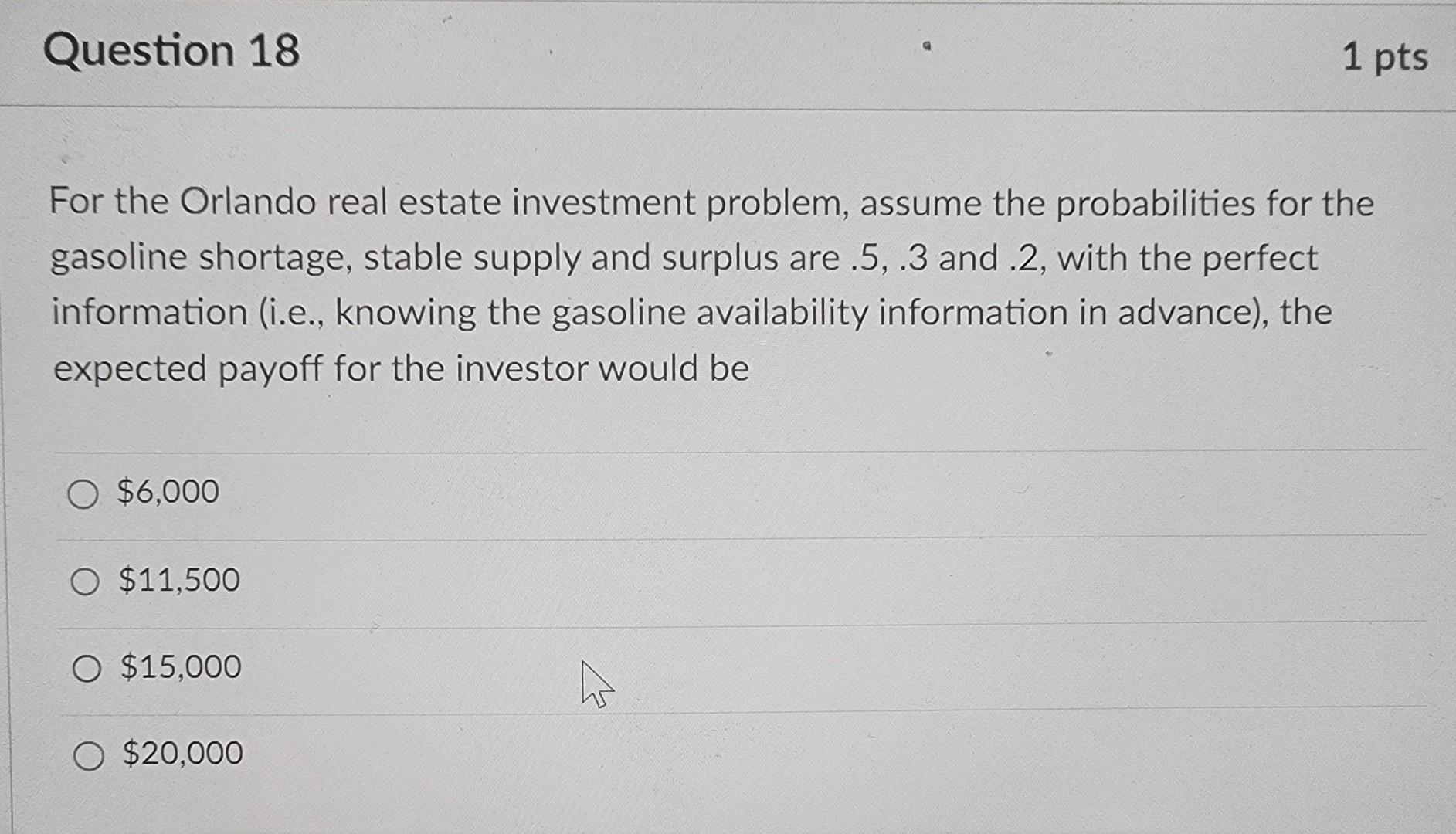

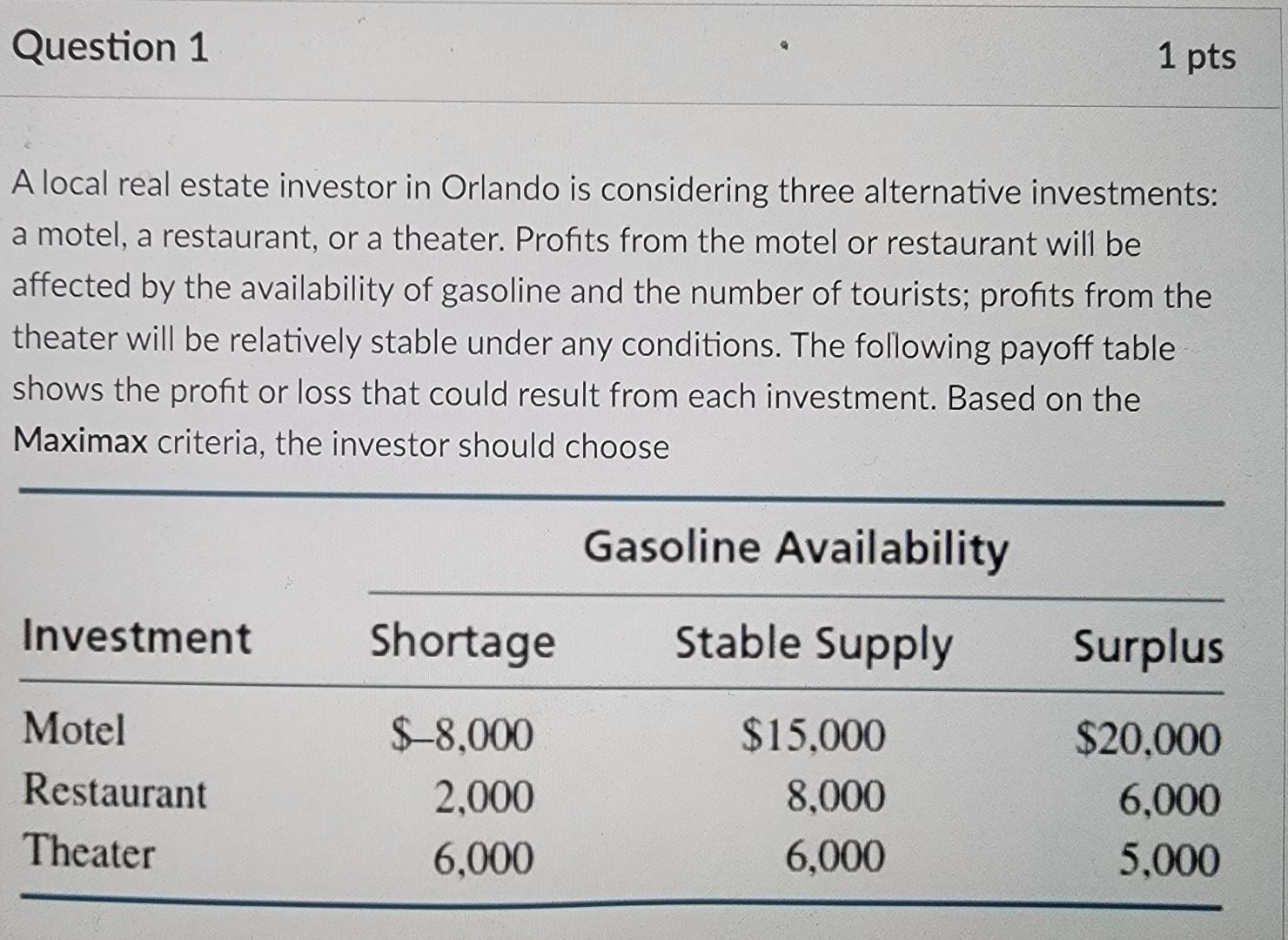

Question 18 For the Orlando real estate investment problem, assume the probabilities for the gasoline shortage, stable supply and surplus are .5, .3 and .2, with the perfect information (i.e., knowing the gasoline availability information in advance), the expected payoff for the investor would be O $6,000 O $11,500 O $15,000 O $20,000 1 pts 4 Question 1 A local real estate investor in Orlando is considering three alternative investments: a motel, a restaurant, or a theater. Profits from the motel or restaurant will be affected by the availability of gasoline and the number of tourists; profits from the theater will be relatively stable under any conditions. The following payoff table shows the profit or loss that could result from each investment. Based on the Maximax criteria, the investor should choose Investment Motel Restaurant Theater Shortage $-8,000 2,000 6,000 Gasoline Availability Stable Supply 1 pts $15,000 8,000 6,000 Surplus $20,000 6,000 5,000Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock