Question: ANSWER QUESTION 2.2 PLEASE 2.1 Basic capital budgeting problem with straight-line depreciation. The Roberts Company has cash inflows of $140,000 per year on project A

ANSWER QUESTION 2.2 PLEASE

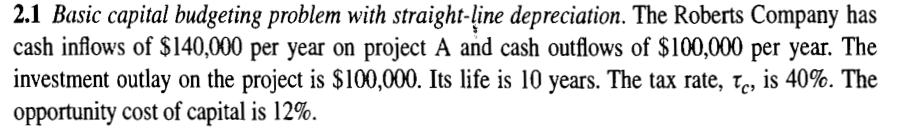

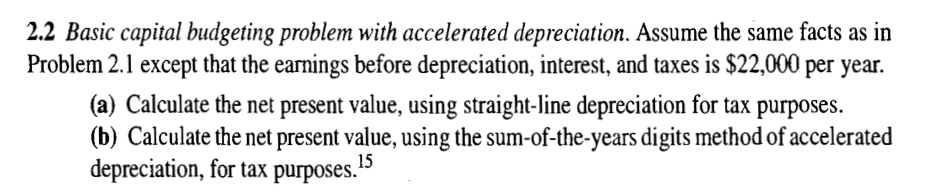

2.1 Basic capital budgeting problem with straight-line depreciation. The Roberts Company has cash inflows of $140,000 per year on project A and cash outflows of $100,000 per year. The investment outlay on the project is $100,000. Its life is 10 years. The tax rate, c, is 40%. The opportunity cost of capital is 12%. 2.2 Basic capital budgeting problem with accelerated depreciation. Assume the same facts as in Problem 2.1 except that the earnings before depreciation, interest, and taxes is $22,000 per year. (a) Calculate the net present value, using straight-line depreciation for tax purposes. (b) Calculate the net present value, using the sum-of-the-years digits method of accelerated depreciation, for tax purposes. 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts