Question: Answer question 26 please CHALLENGE (Questions 25-28) 25. Analyzing a Portfolio [LO2, 4] You have $100,000 to invest in a portfolio containing Stock X and

Answer question 26 please

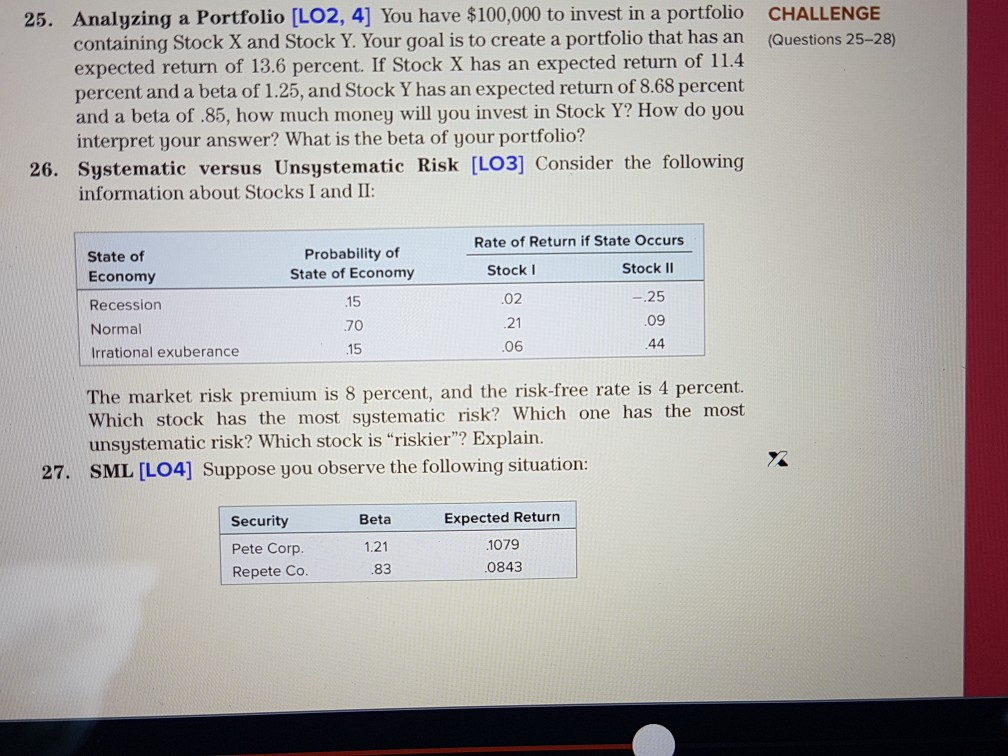

CHALLENGE (Questions 25-28) 25. Analyzing a Portfolio [LO2, 4] You have $100,000 to invest in a portfolio containing Stock X and Stock Y. Your goal is to create a portfolio that has an expected return of 13.6 percent. If Stock X has an expected return of 11.4 percent and a beta of 1.25, and Stock Y has an expected return of 8.68 percent and a beta of .85, how much money will you invest in Stock Y? How do you interpret your answer? What is the beta of your portfolio? 26. Systematic versus Unsystematic Risk [LO3] Consider the following information about Stocks I and II: State of Economy Probability of State of Economy Rate of Return if State Occurs Stock Stock 11 .02 -.25 .09 Recession Normal Irrational exuberance 21 .06 The market risk premium is 8 percent, and the risk-free rate is 4 percent. Which stock has the most systematic risk? Which one has the most unsystematic risk? Which stock is "riskier"? Explain. 27. SML [LO4] Suppose you observe the following situation: Beta Security Pete Corp. Repete Co. 1.21 .83 Expected Return .1079 0843

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts