Question: Answer question 3 or 4 and bonus please 3. Explain the interest rate parity conditions in the following diagram Diagram form: Assume a 90 Days

Answer question 3 or 4 and bonus please

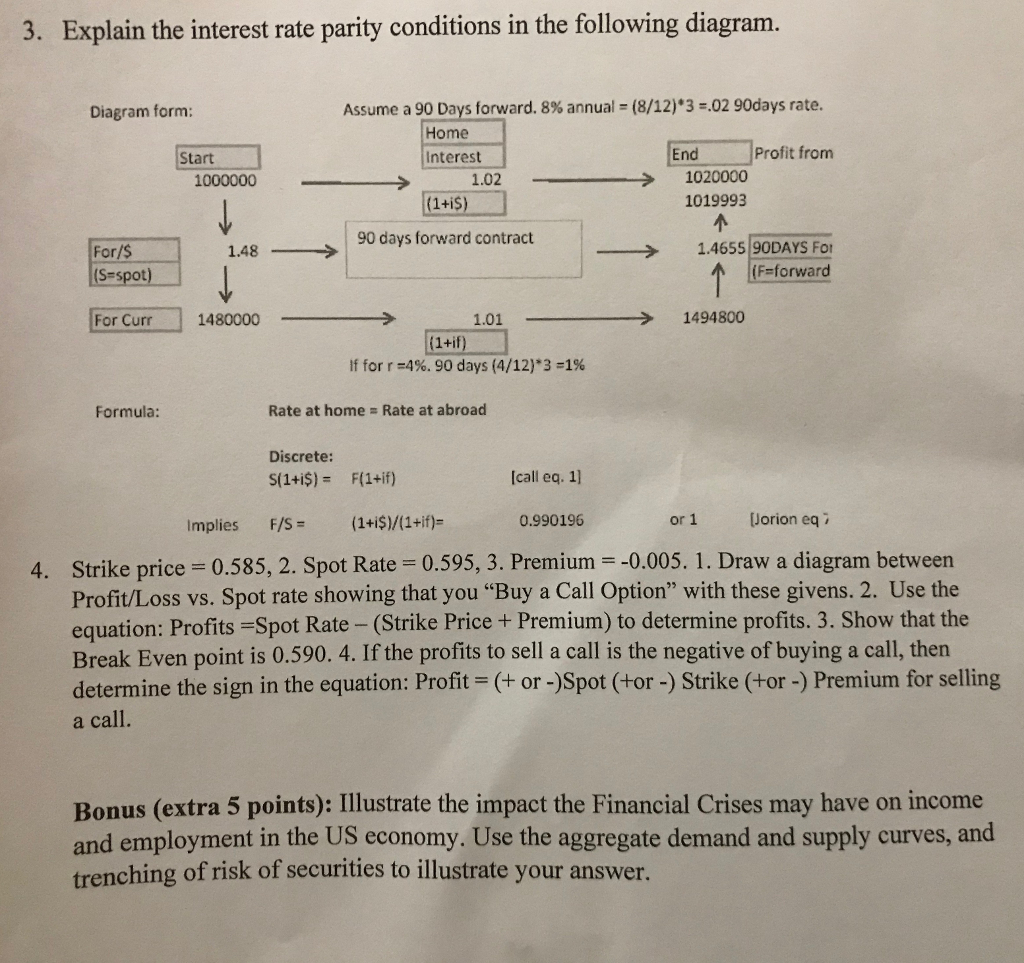

3. Explain the interest rate parity conditions in the following diagram Diagram form: Assume a 90 Days forward. 8% annual-8/12).3-02 90days rate. Home Start Interest End Profit from 1000000 1.021020000 1019993 ? 90 days forward contract For/$ S-spot 1.4655|90DAYS Fo (F-forward 1.48 ? For Curr 1480000 1.01 1494800 1+if If forr-496, 90 days (4/12)*3-196 Formula: Rate at home Rate at abroad Discrete: S(1+iS)-F(1+if) [call eq. 1] or 1 Uorion eq i Implies F/S(1+iS)/(1+if)- 0.990196 4. Strike price 0.585, 2. Spot Rate 0.595, 3. Premium-0.005. 1. Draw a diagram between Profit/Loss vs. Spot rate showing that you "Buy a Call Option" with these givens. 2. Use the equation: Profits-Spot Rate - (Strike Price+ Premium) to determine profits. 3. Show that the Break Even point is 0.590. 4. If the profits to sell a call is the negative of buying a call, then determine the sign in the equation: Profit +or-)Spot (tor-) Strike (+or -) Premium for selling a call. Bonus (extra 5 points): Illustrate the impact the Financial Crises may have on income and employment in the US economy. Use the aggregate demand and supply curves, and trenching of risk of securities to illustrate your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts