Question: Answer Question 3, please! You need Question One to do Three. Problem Three. Calculate the one day holding period return on the bonds in Problem

Answer Question 3, please! You need Question One to do Three.

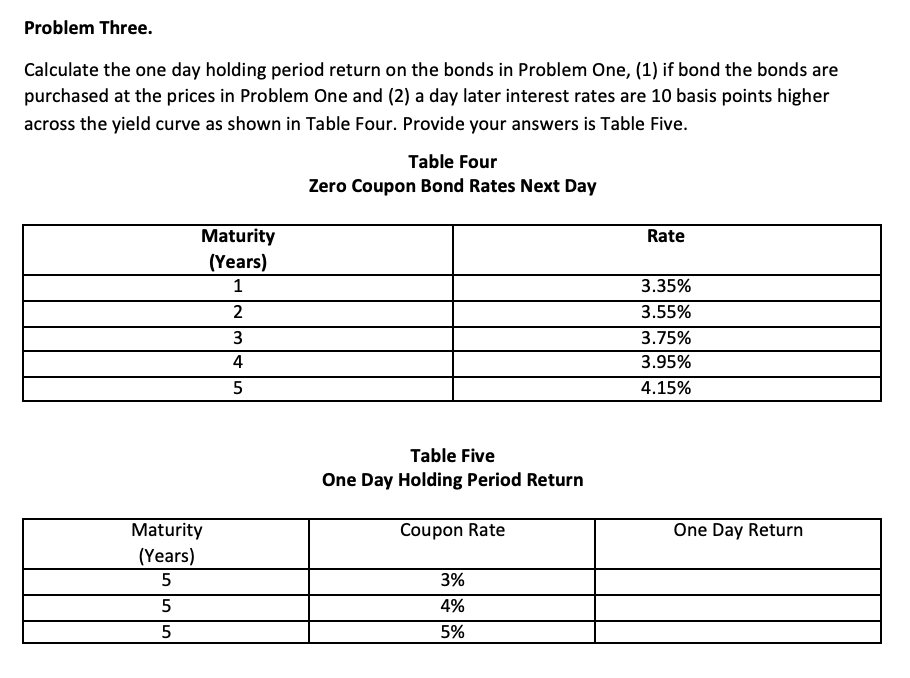

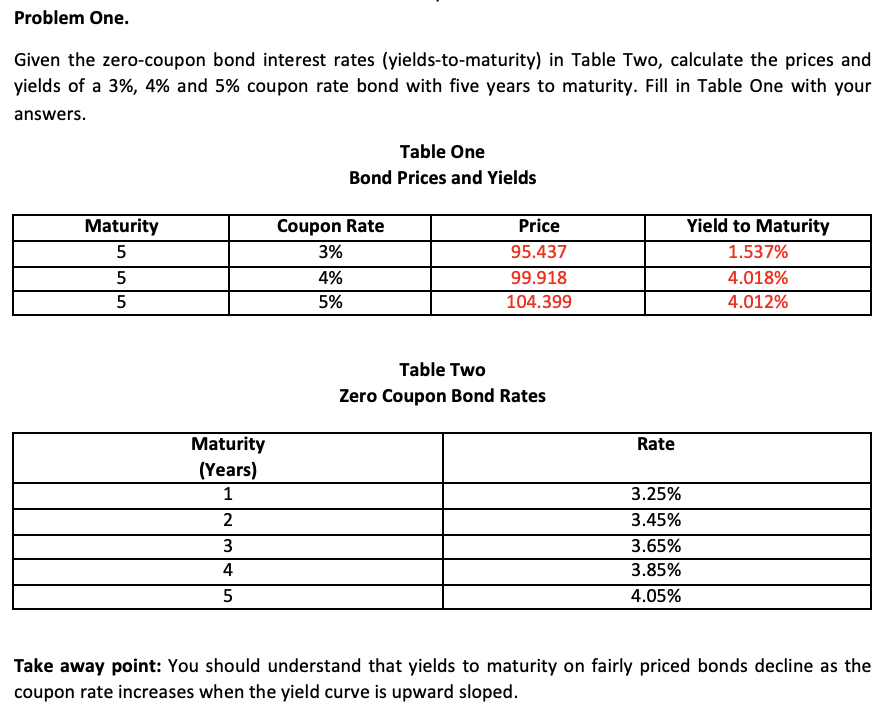

Problem Three. Calculate the one day holding period return on the bonds in Problem One, (1) if bond the bonds are purchased at the prices in Problem One and (2) a day later interest rates are 10 basis points higher across the yield curve as shown in Table Four. Provide your answers is Table Five. Table Four Zero Coupon Bond Rates Next Day Table Five One Day Holding Period Return Given the zero-coupon bond interest rates (yields-to-maturity) in Table Two, calculate the prices and yields of a 3%,4% and 5% coupon rate bond with five years to maturity. Fill in Table One with your answers. Table One Bond Prices and Yields Table Two Zero Coupon Bond Rates Take away point: You should understand that yields to maturity on fairly priced bonds decline as the coupon rate increases when the yield curve is upward sloped. Problem Three. Calculate the one day holding period return on the bonds in Problem One, (1) if bond the bonds are purchased at the prices in Problem One and (2) a day later interest rates are 10 basis points higher across the yield curve as shown in Table Four. Provide your answers is Table Five. Table Four Zero Coupon Bond Rates Next Day Table Five One Day Holding Period Return Given the zero-coupon bond interest rates (yields-to-maturity) in Table Two, calculate the prices and yields of a 3%,4% and 5% coupon rate bond with five years to maturity. Fill in Table One with your answers. Table One Bond Prices and Yields Table Two Zero Coupon Bond Rates Take away point: You should understand that yields to maturity on fairly priced bonds decline as the coupon rate increases when the yield curve is upward sloped

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts