Question: Answer QUESTION 3! Show all work and calculations! O Using the debt ratios provided, write a few bullet points analyzing the relative creditworthiness of Dinsey

Answer QUESTION 3! Show all work and calculations!

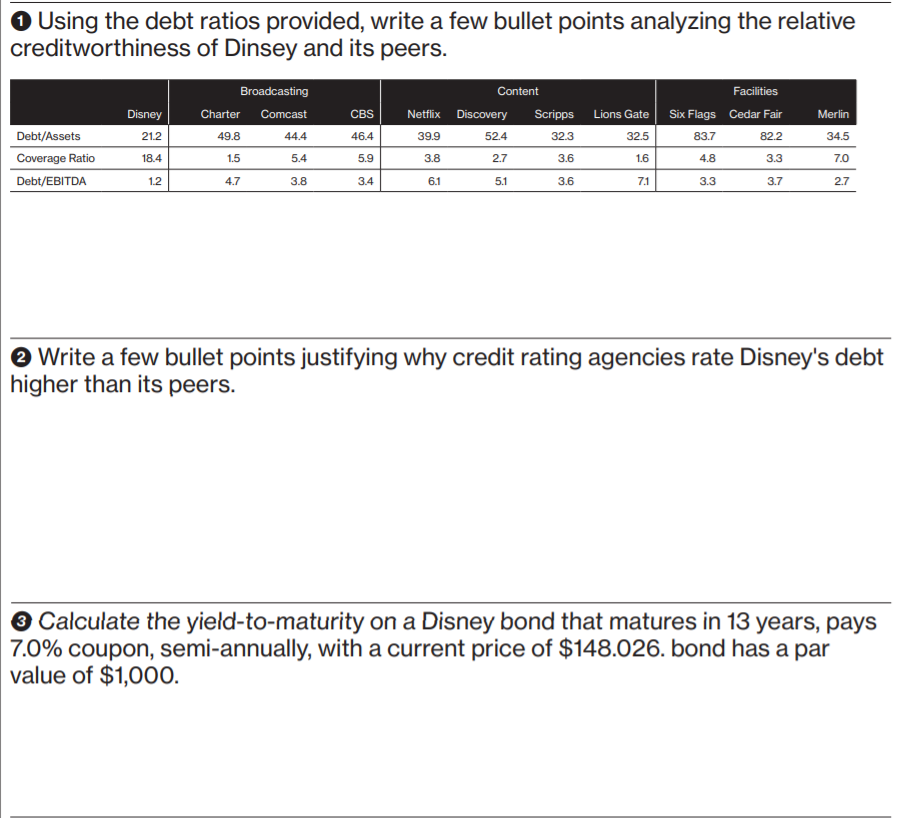

O Using the debt ratios provided, write a few bullet points analyzing the relative creditworthiness of Dinsey and its peers. Disney Broadcasting Charter Comcast 49.8 44.4 CBS Content Netflix Discovery Scripps 39.9 52.4 32.3 Lions Gate Facilities Six Flags Cedar Fair 83.7 82.2 Merlin 21.2 46.4 32.5 34.5 Debt/Assets Coverage Ratio Debt/EBITDA 18.4 1.5 5.4 5.9 3.8 2.7 3.6 1.6 4.8 3.3 7.0 2.7 12 4.7 3.8 3.4 6.1 5.1 3.6 7.1 3.3 3.7 Write a few bullet points justifying why credit rating agencies rate Disney's debt higher than its peers. e Calculate the yield-to-maturity on a Disney bond that matures in 13 years, pays 7.0% coupon, semi-annually, with a current price of $148.026. bond has a par value of $1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts