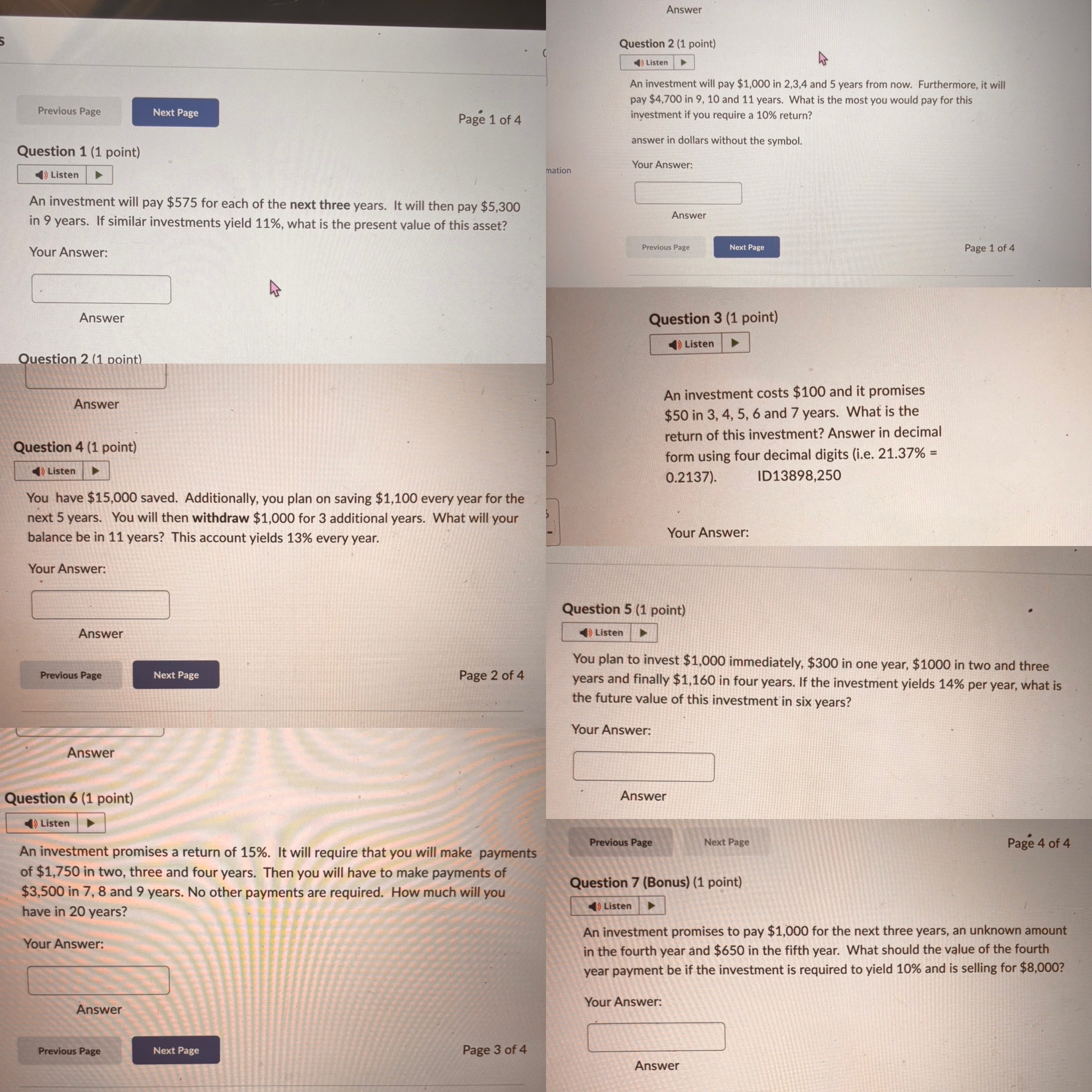

Question: Answer Question 4 ( 1 point ) You have $ 1 5 , 0 0 0 saved. Additionally, you plan on saving $ 1 ,

Answer

Question point

You have $ saved. Additionally, you plan on saving $ every year for the

next years. You will then withdraw $ for additional years. What will your

balance be in years? This account yields every year.

Your Answer:

Answer

Page of

Answer

Question point

An investment promises a return of It will require that you will make payments

of $ in two, three and four years. Then you will have to make payments of

$ in and years. No other payments are required. How much will you

have in years?

Your Answer:

Question point

You plan to invest $ immediately, $ in one year, $ in two and three

years and finally $ in four years. If the investment yields per year, what is

the future value of this investment in six years?

Your Answer:

An investment costs $ and it promises

$ in and years. What is the

return of this investment? Answer in decimal

form using four decimal digits ie

ID

An investment costs $ and it promises

$ in and years. What is the

return of this investment? Answer in decimal

form using four decimal digits ie

ID

An investment costs $ and it promises

$ in and years. What is the

return of this investment? Answer in decimal

form using four decimal digits ie

ID

An investment costs $ and it promises

$ in and years. What is the

return of this investment? Answer in decimal

form using four decimal digits ie

ID

An investment costs $ and it promises

$ in and years. What is the

return of this investment? Answer in decimal

form using four decimal digits ie

ID

An investment costs $ and it promises

$ in and years. What is the

return of this investment? Answer in decimal

form using four decimal digits ie

ID

Your Answer:

Question Bonus point

An investment promises to pay $ for the next three years, an unknown amount

in the fourth year and $ in the fifth year. What should the value of the fourth

year payment be if the investment is required to yield and is selling for $

Your Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock