Question: Answer question 4 based upon the following information: An American trader has to make a foreign currency payment in six months on imported goods that

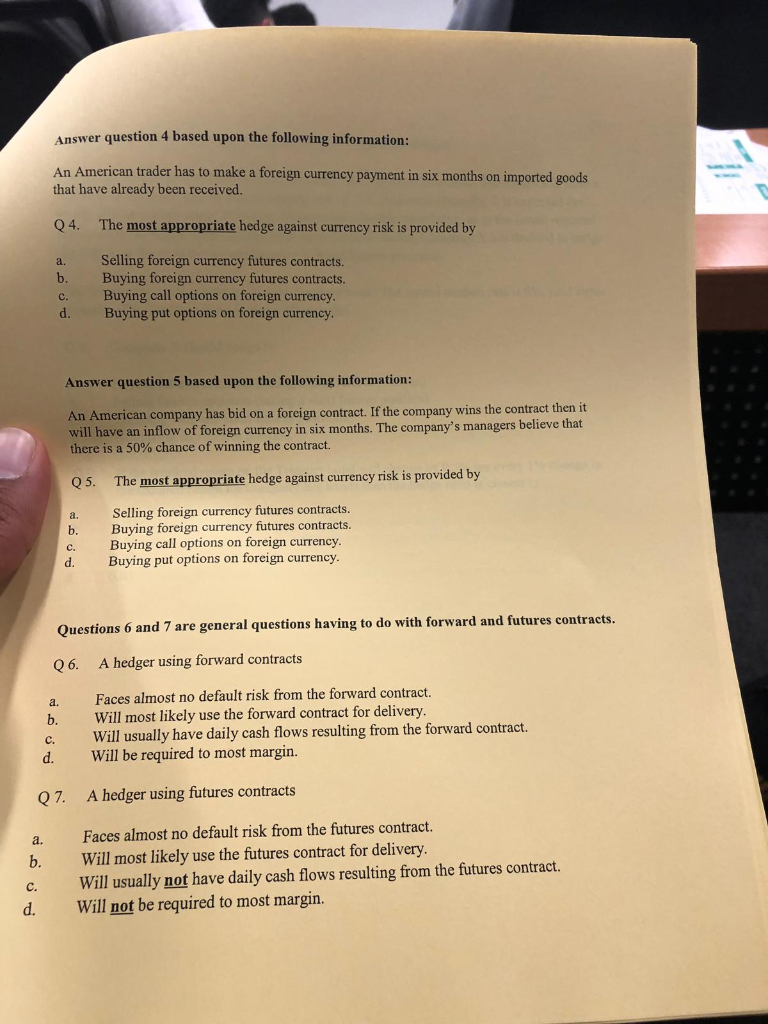

Answer question 4 based upon the following information: An American trader has to make a foreign currency payment in six months on imported goods that have already been received. Q4. The most appropriate hedge against currency risk is provided by a. Selling foreign currency futures contracts. b. Buying foreign currency futures contracts. c. Buying call options on foreign currency d. Buying put options on foreign currency. Answer question 5 based upon the following information: An American company has bid on a foreign contract. If the company wins the contract will have an inflow of foreign currency in six months. The company's managers believe that there is a 50% chance of winning the contract. then it The most appropriate hedge against currency risk is provided by Q5. a. Selling foreign currency futures contracts. b. Buying foreign currency futures contracts. c. Buying call options on foreign currency. d. Buying put options on foreign currency. Questions 6 and 7 are general questions having to do with forward and futures contracts A hedger using forward contracts Q6. Faces almost no default risk from the forward contract. Will most likely use the forward contract for delivery. Will usually have daily cash flows resulting from the forward contract. a. b. c. d. be required to most margin. A hedger using futures contracts Q7. a. Faces almost no default risk from the futures contract. b. Will most likely use the futures contract for delivery c. Will usually not have daily cash flows resulting from the futures contract d. Will not be required to most margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts