Question: answer question 4 please. 2. Trini Company had the following transactions for the month. Calculate the ending inventory dollar value for each of the following

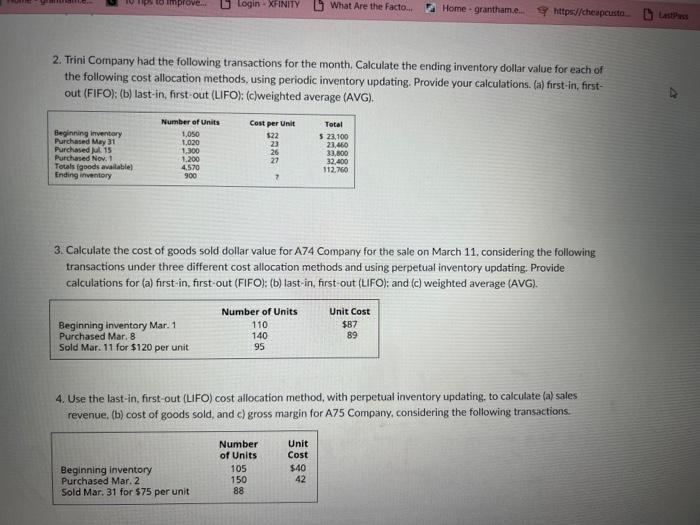

2. Trini Company had the following transactions for the month. Calculate the ending inventory dollar value for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. (a) first-in, firstout (FIFO); (b) last-in, first-out (LIFO); (c)weighted average (AVG). 3. Calculate the cost of goods sold dollar value for A74 Company for the sale on March 11, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO): (b) last-in, first-out (LIFO): and (c) weighted average (AVG). 4. Use the last-in, first-out (LIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts