Question: answer question 4 please Low Chrysler and mate market val selling for $52 unding and for tanding. Please Mart, with $55 bill 5 percent i

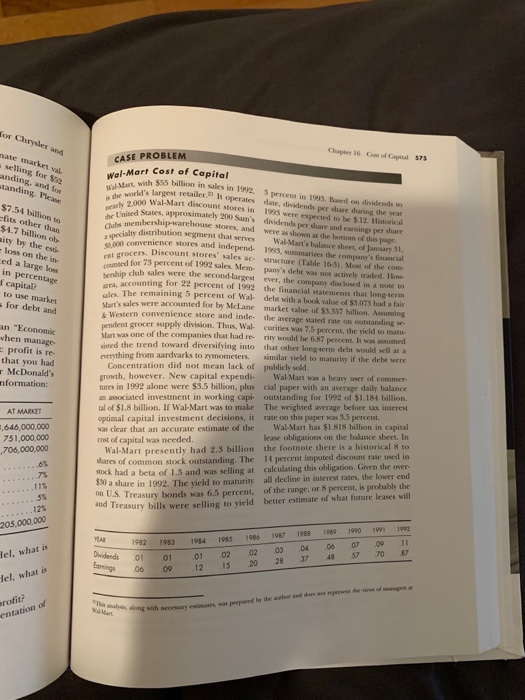

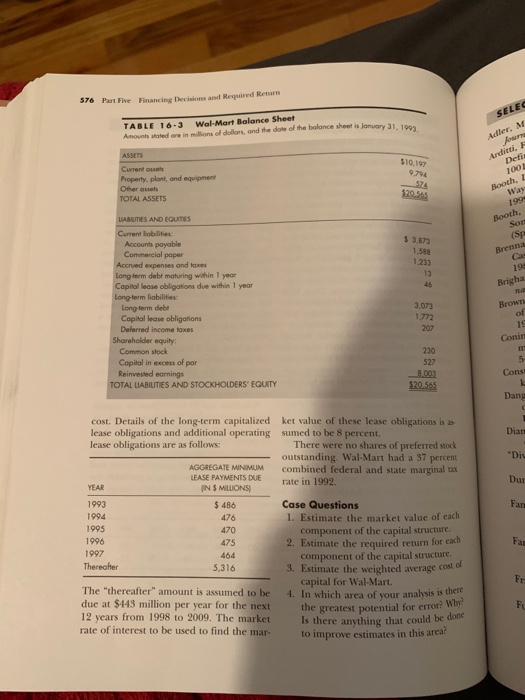

Low Chrysler and mate market val selling for $52 unding and for tanding. Please Mart, with $55 bill 5 percent i din to date, dividende per shared 1993 were expected to be $ 12. Misal the United States $7.54 billion to efits other than $4.7 billion ob aity by the esti loss on the in ced a large los in percentage capital? to use market for debt and Chris G 575 CASE PROBLEM Wal-Mart Cost of Capital with $55 billion in sales in 1992, d's largest retailer li operates 000 Wal-Mart discount stores in the war d e s, approximately 200 Sam's dividends per share and earnings per share ambership warehouse Mores, and were as shown at the bottom of this page distribution segment that serves Wal- Man's balance sheet of January 31, venience stores and independ 1993, summarizes the company's financial ers. Discount stores sales ac structure Table 16-3). Most of the com for 75 percent of 1992 ales. Mempaw's debt was not actively traded. Ilone club sales were the second largest ever, the company disclosed in a note to accounting for 2 percent of 1992 the financial statements that long term The remaining 5 percent of Wal debe with a book o l dal Wet's sales were accounted for by McLane market value of $157 balla A ming Western convenience store and inde the average stated rate o utstanding se dent grocer supply division. Thus, Wal- curities was 7.5 percent, the yield tot Vai was one of the companies that had rerity would be 6.87 percent. It was assumed red the trend toward diversifying into that other long-term debt would sell at a enthing from aardvarks to zmometers. similar yield to matury if the debt were Concentration did not mean lack of publicly sold prowth, however. New capital expendi Wal-Mart was a heavy wiser of commer- cial paper with an average daily balance tures in 1992 alone were $3.5 billion, plus cated investment in working capi- outstanding for 1992 of $1.184 billion. the weighted average before tax interest al of $1.8 billion. If Wal-Mart was to make rate on this paper was 3.5 percent. optimal capital investment decisions, it Wal-Mart has $1.818 billion in capital was clear that an accurate estimate of the lease obligations on the balance sheet. In cost of capital was needed. an "Economic when manage profit is re- that you had McDonald's for Larient: AT MARKET 3,646,000,000 751,000,000 ,706,000,000 Wal-Mart presently had 2.3 billion the footnote there is a historical 8 to shares of common stock outstanding. The 14 percent imputed discount rate used in stock had a beta of 1.5 and was selling at calculating this obligation. Given the over a share in 1992. The vield to maturity all decline in interest rates, the lower end on US Treasury bonds was 65 percent of the range, or 8 percent, is probably the and Treasury bills were selling to yield betier estimate of what future leases will 205,000,000 195 02 15 1982 1983 194 010101 0 6 09 12 1986 02 20 1987 03 28 1988 04 37 1989 06 48 el, what is 1990 07 57 1991 09 70 1992 11 87 ends 9 el, what is profit? entation of 576 Part Five Financing Decisions and Required Reum TABLE 16-3 Wal-Mart Balance Sheet Amounts soledare in millions of dollars, and the date of the balance sheet is January 31, 100 SELEC Adler, M ASSETS Arditi, Defit Current ou Property, plant, and equipment Other aus TOTAL ASSETS $10,197 9,794 574 1001 Booth, $20.56 Way 1994 Booth, $ 3.873 1 58 1233 (SP Brenna 198 1 Brigha LIABUITIES AND EQUITES Current Mobilities Accounts payable Commercial paper Accrued expenses and taxes Long-term debt maturing within 1 year Capital lease obligations due within 1 year Long-term liabilities Long term debe Capital lease obligations Deferred Income taxes Shareholder equity: Common stock Capital in excess of par Reinvested earnings TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY Brown 3,073 1772 207 of Conin 230 527 Cons 8.003 $20.565 Dang cost. Details of the long-term capitalized lease obligations and additional operating lease obligations are as follows: Dian ket value of these lease obligations is as sumed to be 8 percent. There were no shares of preferred stock outstanding. Wal-Mart had a 37 percent combined federal and state marginal tax rate in 1992 LEASE PAYMENTS DUE IN S MLIONS $ 486 476 YEAR 1993 1994 1995 1996 1997 Thereafter 470 475 464 5,316 Case Questions 1. Estimate the market value of each component of the capital structure. 2. Estimate the required return for each component of the capital structure. 3. Estimate the weighted average cost of capital for Wal-Mart. 4. In which area of your analysis is balsis is there the greatest potential for error? Why? is there anything that could be to improve estimates in this area? The "thereafter" amount is assumed to be due at $143 million per year for the next 12 years from 1998 to 2009. The market rate of interest to be used to find the mar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts