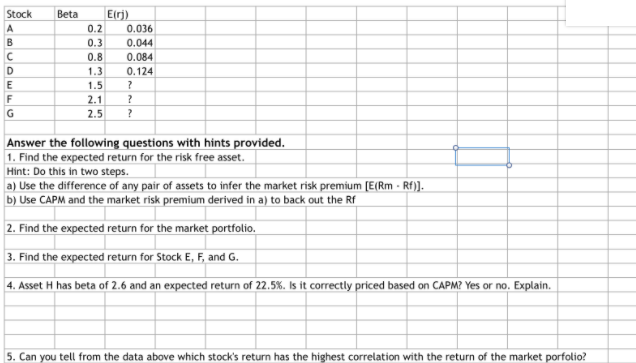

Question: ANSWER QUESTION 5 ONLY. #5: Can you tell from the data below which stock's return has the highest correlation with the return of the market

ANSWER QUESTION 5 ONLY.

#5: Can you tell from the data below which stock's return has the highest correlation with the return of the market portfolio? CLUE: Involves how beta is calculated and Covariance.

#1 answer: Expected Return on Risk Free Asset(RF)= 0.02 OR 2%

#2 answer: Expected Return for the market portfolio = 10%

#3 answer: Expected Return of Stock E = 0.1400 Expected Return of Stock F=0.1888 Expected Return of Stock G=0.220

#4 Answer: EXpected Return of Stock H = 22.8%

Stock Beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts