Question: answer question 5 please 1. (20 points) Consider recent monthly prices and dividends for Mermaid Shipping Co (MSC) stock: The Mermaid Shipping Company Month Ended

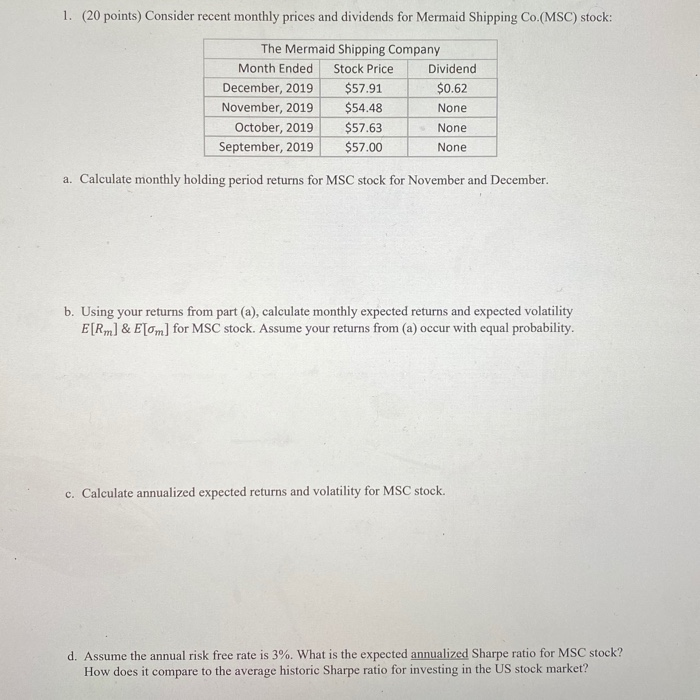

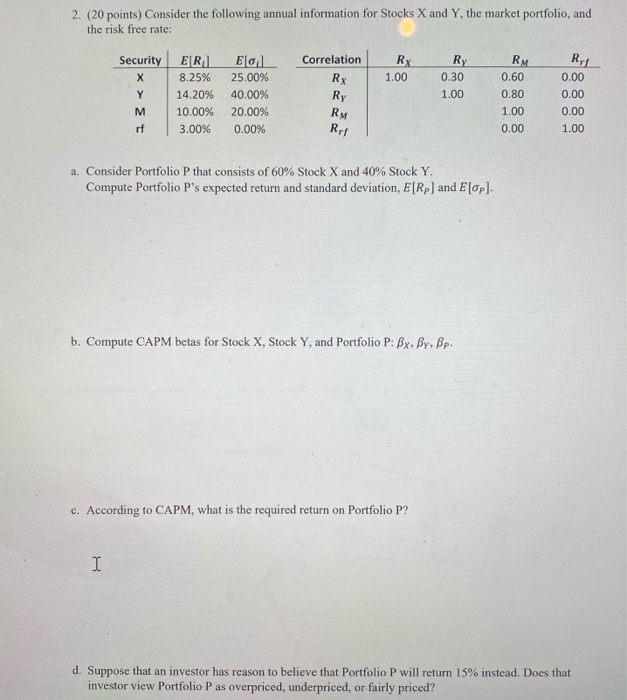

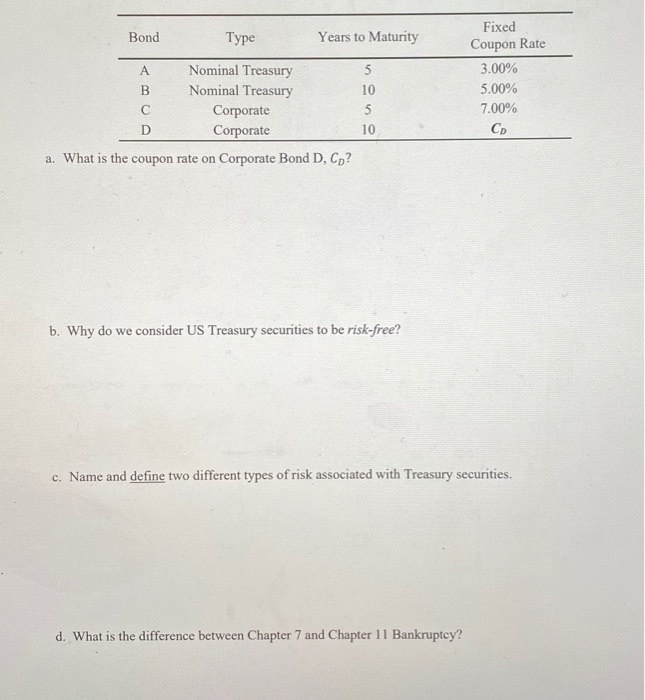

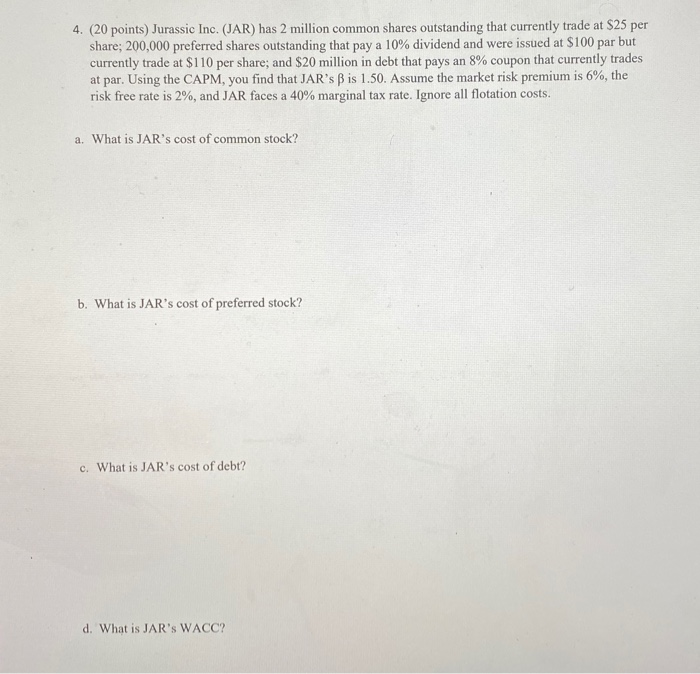

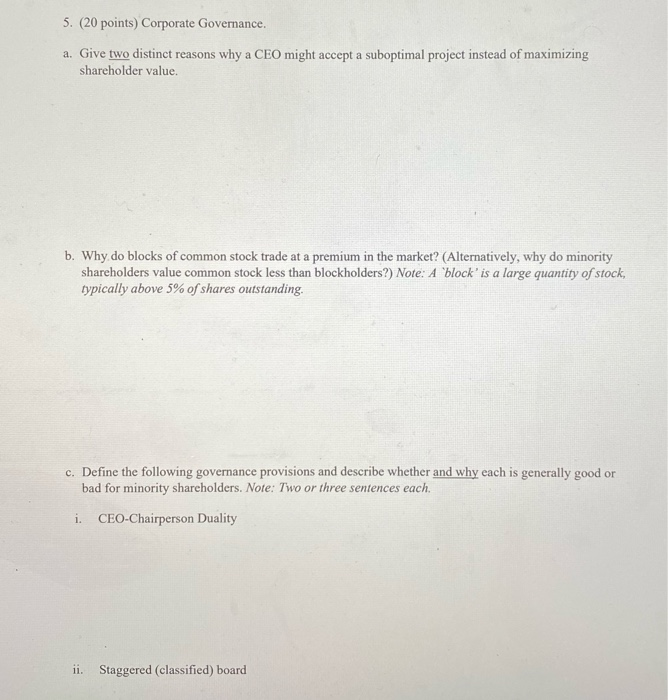

1. (20 points) Consider recent monthly prices and dividends for Mermaid Shipping Co (MSC) stock: The Mermaid Shipping Company Month Ended Stock Price Dividend December, 2019 $57.91 $0.62 November, 2019 $54.48 None October, 2019 $57.63 None September, 2019 $57.00 None a. Calculate monthly holding period returns for MSC stock for November and December. b. Using your returns from part (a), calculate monthly expected returns and expected volatility E[Rm] & E[Om] for MSC stock. Assume your returns from (a) occur with equal probability. c. Calculate annualized expected returns and volatility for MSC stock. d. Assume the annual risk free rate is 3%. What is the expected annualized Sharpe ratio for MSC stock? How does it compare to the average historic Sharpe ratio for investing in the US stock market? 2. (20 points) Consider the following annual information for Stocks X and Y, the market portfolio, and the risk free rate: Security Correlation RX RM Rus 1.00 E[R] 8.25% 14.20% 10.00% 3.00% Y Elol 25.00% 40.00% 20.00% 0.00% 0.30 1.00 0.60 0.80 1.00 0.00 0.00 0.00 0.00 1.00 M RM rf a. Consider Portfolio P that consists of 60% Stock X and 40% Stock Y. Compute Portfolio P's expected return and standard deviation, E[Rp) and Elop]. b. Compute CAPM betas for Stock X, Stock Y, and Portfolio P: Bx, By, Bp. c. According to CAPM, what is the required return on Portfolio P? I uppose that an investor has reason to believe that Portfolio P will return 15% instead. Does that investor view Portfolio P as overpriced, underpriced, or fairly priced? Bond Type Years to Maturity Nominal Treasury Nominal Treasury Corporate Corporate a. What is the coupon rate on Corporate Bond D, Cp? Fixed Coupon Rate 3.00% 5.00% 7.00% CD b. Why do we consider US Treasury securities to be risk-free? c. Name and define two different types of risk associated with Treasury securities. d. What is the difference between Chapter 7 and Chapter 11 Bankruptcy? 4. (20 points) Jurassic Inc. (JAR) has 2 million common shares outstanding that currently trade at $25 per share; 200,000 preferred shares outstanding that pay a 10% dividend and were issued at $100 par but currently trade at $110 per share; and $20 million in debt that pays an 8% coupon that currently trades at par. Using the CAPM, you find that JAR's B is 1.50. Assume the market risk premium is 6%, the risk free rate is 2%, and JAR faces a 40% marginal tax rate. Ignore all flotation costs. a. What is JAR's cost of common stock? b. What is JAR's cost of preferred stock? c. What is JAR's cost of debt? d. What is JAR'S WACC? 5. (20 points) Corporate Governance. a. Give two distinct reasons why a CEO might accept a suboptimal project instead of maximizing shareholder value. b. Why do blocks of common stock trade at a premium in the market? (Alternatively, why do minority shareholders value common stock less than blockholders?) Note: A 'block' is a large quantity of stock, typically above 5% of shares outstanding c. Define the following governance provisions and describe whether and why each is generally good or bad for minority shareholders. Note: Two or three sentences each. i. CEO-Chairperson Duality ii. Staggered (classified) board

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts