Question: Answer question 5 please with work. Thank you so much! QUESTION 4 Kristine wants to invest in two stocks Stocks X and Z Stock X

Answer question 5 please with work. Thank you so much!

Answer question 5 please with work. Thank you so much!

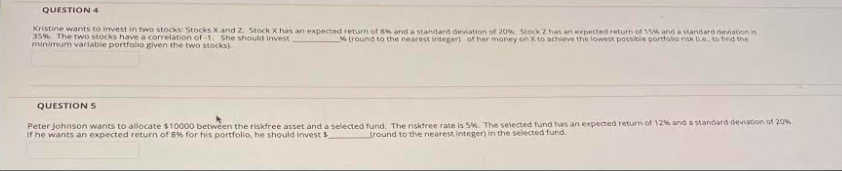

QUESTION 4 Kristine wants to invest in two stocks Stocks X and Z Stock X has an expected return of and a standard deviation of 20 Stock Z has an expected return of 154 and a standard deviations 35%. The two stocks have a correlation of 1. She should invest minimum variable portfolio given the two stocks). _tround to the nearest integer) of her money on X to achieve the lowest possible portoloke to find the QUESTIONS Peter Johnson wants to allocate $10000 between the riskfree asset and a selected fund. The risktree rate is 5%. The selected fund has an expected return of 12% and a standard deviation of 20% if he wants an expected return of 8% for his portfolio, he should invest $ tround to the nearest Integer) in the selected fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts