Question: Answer Question 5. You need Question One to do Five. Now let's suppose that we wake up a year from now and observe the yield

Answer Question 5. You need Question One to do Five.

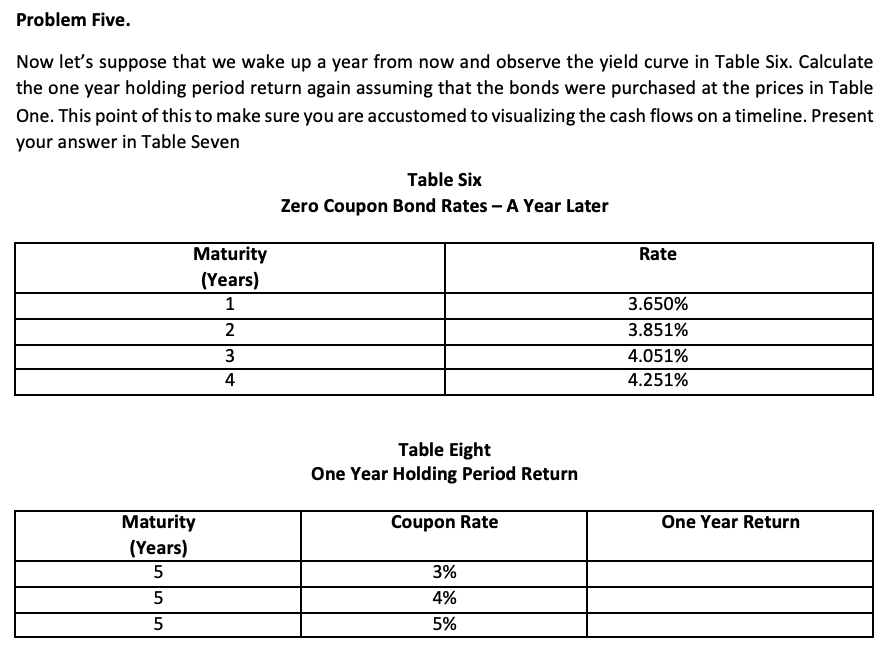

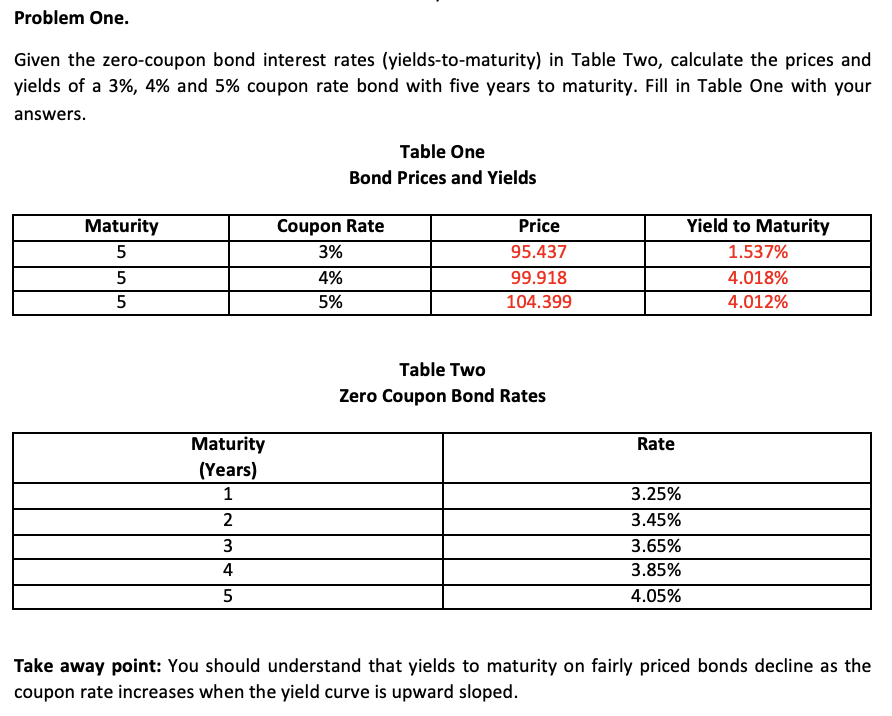

Now let's suppose that we wake up a year from now and observe the yield curve in Table Six. Calculate the one year holding period return again assuming that the bonds were purchased at the prices in Table One. This point of this to make sure you are accustomed to visualizing the cash flows on a timeline. Present your answer in Table Seven Table Six Zero Coupon Bond Rates - A Year Later Table Eight One Year Holding Period Return Given the zero-coupon bond interest rates (yields-to-maturity) in Table Two, calculate the prices and yields of a 3%,4% and 5% coupon rate bond with five years to maturity. Fill in Table One with your answers. Table One Bond Prices and Yields Table Two Zero Coupon Bond Rates Take away point: You should understand that yields to maturity on fairly priced bonds decline as the coupon rate increases when the yield curve is upward sloped. Now let's suppose that we wake up a year from now and observe the yield curve in Table Six. Calculate the one year holding period return again assuming that the bonds were purchased at the prices in Table One. This point of this to make sure you are accustomed to visualizing the cash flows on a timeline. Present your answer in Table Seven Table Six Zero Coupon Bond Rates - A Year Later Table Eight One Year Holding Period Return Given the zero-coupon bond interest rates (yields-to-maturity) in Table Two, calculate the prices and yields of a 3%,4% and 5% coupon rate bond with five years to maturity. Fill in Table One with your answers. Table One Bond Prices and Yields Table Two Zero Coupon Bond Rates Take away point: You should understand that yields to maturity on fairly priced bonds decline as the coupon rate increases when the yield curve is upward sloped

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts