Question: answer question 6-8, 11 and 16. I have some information dron textbook, please provide more information. that as the partnership is not a separate legal

answer question 6-8, 11 and 16. I have some information dron textbook, please provide more information.

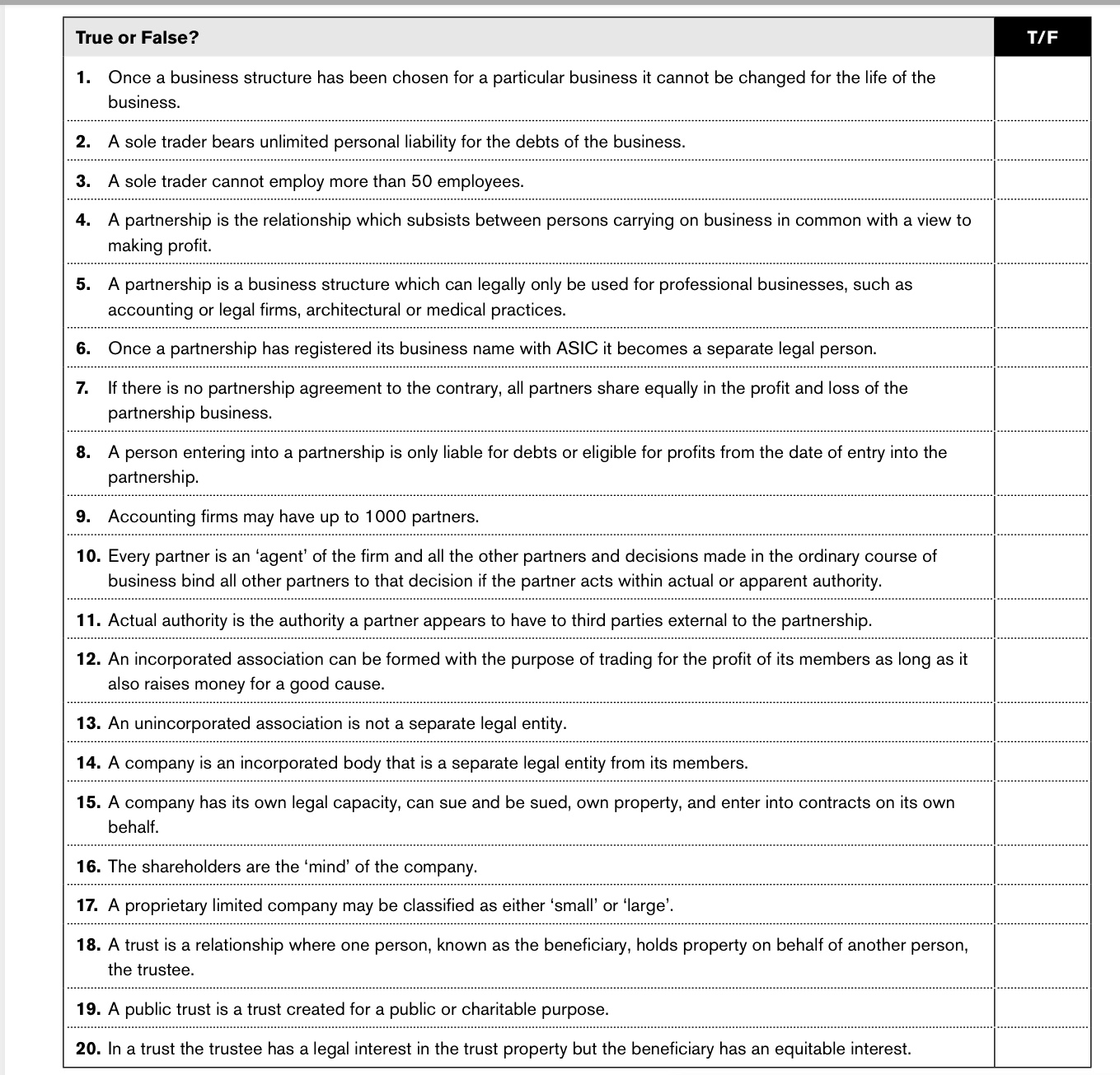

that as the partnership is not a separate legal entity, when a partner resigns or dies, the partnership as it existed dissolves. A person entering into a partnership is only liable for debts or eligible for prot: from the date of entry. A partnership has no separate entity from that of the partners.That means legal liability falls entirely on the partners and is unlimited in most cases. If there is no written agreement, the provisions of the various Partnership Acts in each State and Territory will apply as providing 'default' provisions applicable to the partnership which may not represent the wishes of the partners. For example, it is a default position in the State and Territory Partnership Acts that in the absence of any express agreement to the contrary, each partner will share equally in the profit and loss. But what if one partner has contributed 80% of the work and 60% of the capital and the other has contributed only 20% of the work and only 40% of the capital. It is easy to see how such a situation may lead to disputes.Apparent authority is very important for those dealing with a partner. It is rare for a person outside the partnership to have access to the confidential partnership agreement itself, so they are allowed to rely on apparent authority - the authority a partner appears to have to third parties external to the partnership. 96True or False? T/F 1. Once a business structure has been chosen for a particular business it cannot be changed for the life of the business 2. A sole trader bears unlimited personal liability for the debts of the business. 3. A sole trader cannot employ more than 50 employees. 4. A partnership is the relationship which subsists between persons carrying on business in common with a view to making profit. 5. A partnership is a business structure which can legally only be used for professional businesses, such as accounting or legal firms, architectural or medical practices. 6. Once a partnership has registered its business name with ASIC it becomes a separate legal person. 7. If there is no partnership agreement to the contrary, all partners share equally in the profit and loss of the partnership business. 8. A person entering into a partnership is only liable for debts or eligible for profits from the date of entry into the partnership. 9. Accounting firms may have up to 1000 partners. 10. Every partner is an 'agent' of the firm and all the other partners and decisions made in the ordinary course of business bind all other partners to that decision if the partner acts within actual or apparent authority. 11. Actual authority is the authority a partner appears to have to third parties external to the partnership 12. An incorporated association can be formed with the purpose of trading for the profit of its members as long as it also raises money for a good cause. 13. An unincorporated association is not a separate legal entity. 14. A company is an incorporated body that is a separate legal entity from its members. 15. A company has its own legal capacity, can sue and be sued, own property, and enter into contracts on its own behalf. 16. The shareholders are the 'mind' of the company. 17. A proprietary limited company may be classified as either 'small' or 'large'. 18. A trust is a relationship where one person, known as the beneficiary, holds property on behalf of another person, the trustee. 19. A public trust is a trust created for a public or charitable purpose. 20. In a trust the trustee has a legal interest in the trust property but the beneficiary has an equitable interest