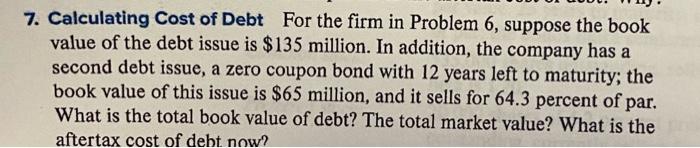

Question: Answer question 7. 2nd picture is question 6. 7. Calculating Cost of Debt For the firm in Problem 6, suppose the book value of the

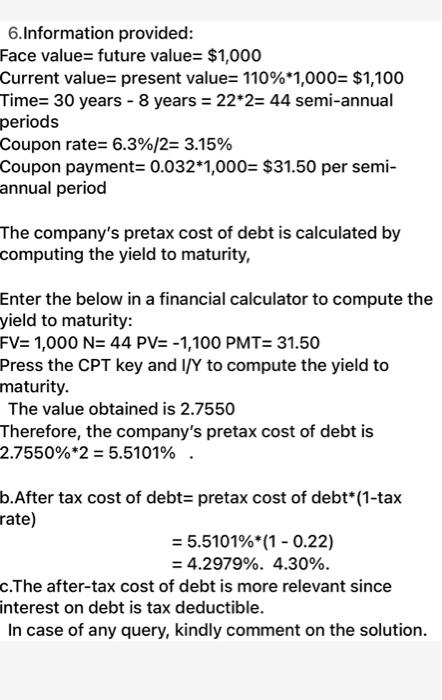

7. Calculating Cost of Debt For the firm in Problem 6, suppose the book value of the debt issue is $135 million. In addition, the company has a second debt issue, a zero coupon bond with 12 years left to maturity; the book value of this issue is $65 million, and it sells for 64.3 percent of par. What is the total book value of debt? The total market value? What is the aftertax cost of debt now? 6.Information provided: Face value= future value= $1,000 Current value= present value= 110%*1,000= $1,100 Time= 30 years - 8 years = 22*2= 44 semi-annual periods Coupon rate= 6.3%/2= 3.15% Coupon payment=0.032*1,000= $31.50 per semi- annual period The company's pretax cost of debt is calculated by computing the yield to maturity, Enter the below in a financial calculator to compute the yield to maturity: FV= 1,000 N= 44 PV= -1,100 PMT= 31.50 Press the CPT key and I/Y to compute the yield to maturity. The value obtained is 2.7550 Therefore, the company's pretax cost of debt is 2.7550%*2 = 5.5101% b.After tax cost of debt=pretax cost of debt*(1-tax rate) = 5.5101%*(1 - 0.22) = 4.2979%. 4.30%. c.The after-tax cost of debt is more relevant since interest on debt is tax deductible. In case of any query, kindly comment on the solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts