Question: ANSWER QUESTION 7, ANSWER FOR QUESTION 6 BELOW: 6) (10 pts) A 30-year bond matures in 7 years sells for $1,020, pays interest semiannually, and

ANSWER QUESTION 7, ANSWER FOR QUESTION 6 BELOW:

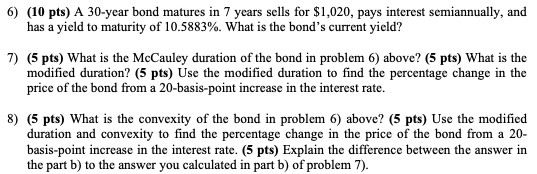

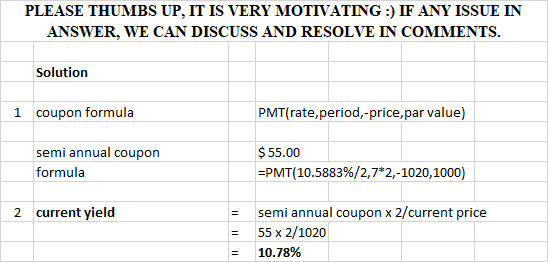

6) (10 pts) A 30-year bond matures in 7 years sells for $1,020, pays interest semiannually, and has a yield to maturity of 10.5883%. What is the bond's current yield? 7) (5 pts) What is the McCauley duration of the bond in problem 6) above? (5 pts) What is the modified duration? (5 pts) Use the modified duration to find the percentage change in the price of the bond from a 20-basis-point increase in the interest rate. 8) (5 pts) What is the convexity of the bond in problem 6) above? (5 pts) Use the modified duration and convexity to find the percentage change in the price of the bond from a 20- basis-point increase in the interest rate. (5 pts) Explain the difference between the answer in the part b) to the answer you calculated in part b) of problem 7). PLEASE THUMBS UP, IT IS VERY MOTIVATING :) IF ANY ISSUE IN ANSWER, WE CAN DISCUSS AND RESOLVE IN COMMENTS. Solution 1 coupon formula PMT(rate, period, -price,par value) semi annual coupon formula $ 55.00 =PMT(10.5883%/2,7*2,-1020,1000) 2 current yield II semi annual coupon x 2/current price 55 x 2/1020 10.78% =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts