Question: Answer Question 9 (1 point) A stock is trading for 20, and just paid a dividend of 1.1 which is expected to grow at a

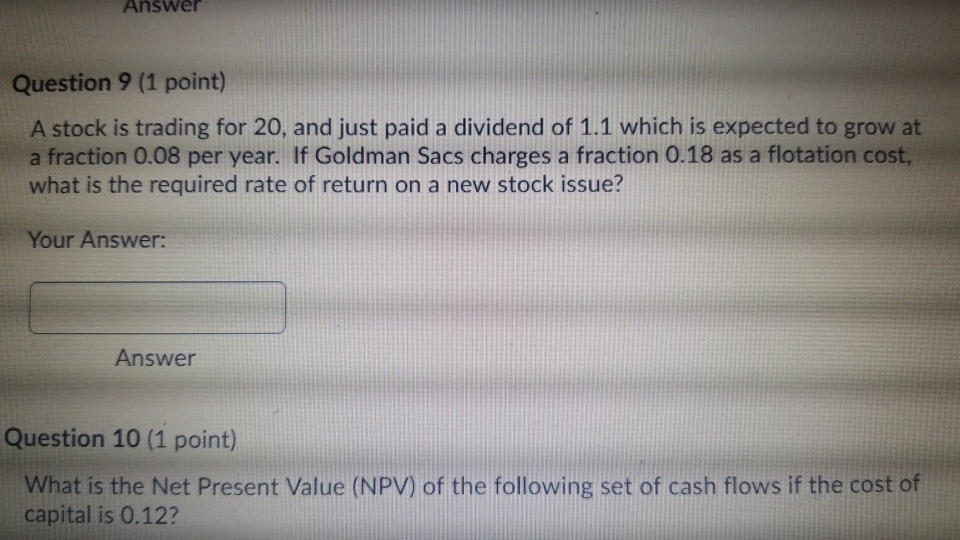

Answer Question 9 (1 point) A stock is trading for 20, and just paid a dividend of 1.1 which is expected to grow at a fraction 0.08 per year. If Goldman Sacs charges a fraction 0.18 as a flotation cost, what is the required rate of return on a new stock issue? Your Answer: Answer Question 10 (1 point) What is the Net Present Value (NPV) of the following set of cash flows if the cost of capital is 0.12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts