Question: Answer question 9 only, please? Thank you. BTC FEEDS N4d - 6:06 PM 8. Project R has a cost of $ 10,000 and in expected

Answer question 9 only, please? Thank you.

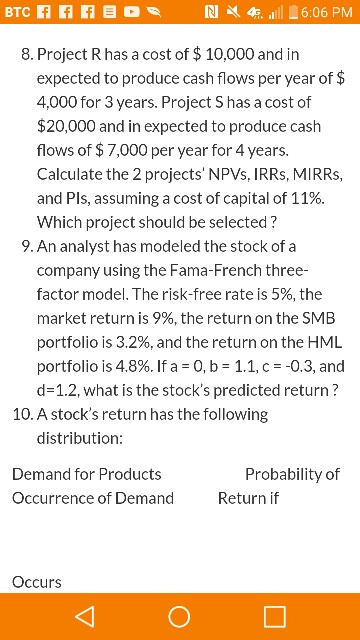

BTC FEEDS N4d - 6:06 PM 8. Project R has a cost of $ 10,000 and in expected to produce cash flows per year of $ 4,000 for 3 years. Project S has a cost of $20,000 and in expected to produce cash flows of $ 7,000 per year for 4 years. Calculate the 2 projects' NPVS, IRRS, MIRRS, and Pls, assuming a cost of capital of 11%. Which project should be selected ? 9. An analyst has modeled the stock of a company using the Fama-French three- factor model. The risk-free rate is 5%, the market return is 9%, the return on the SMB portfolio is 3.2%, and the return on the HML portfolio is 4.8%. If a = 0, b = 1.1, C = -0.3, and d=1.2, what is the stock's predicted return? 10.A stock's return has the following distribution: Demand for Products Occurrence of Demand Probability of Return if Occurs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts