Question: answer question A, B, C, and D For this case study, you and your teammates are part of the management team of a company that

answer question A, B, C, and D

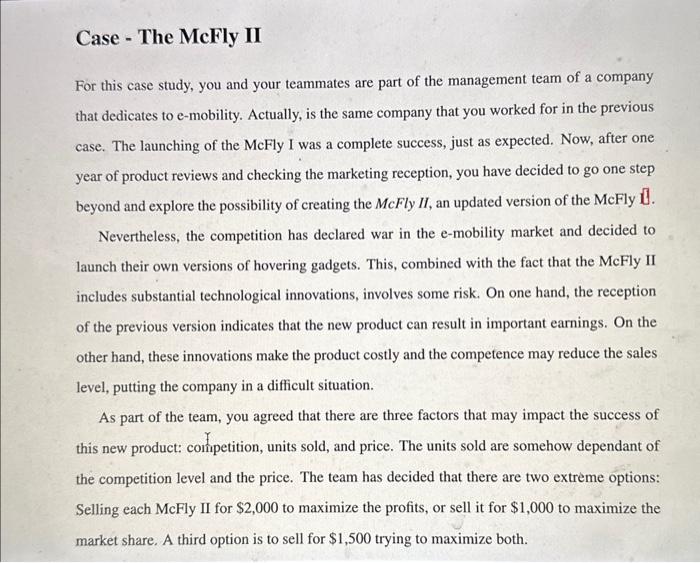

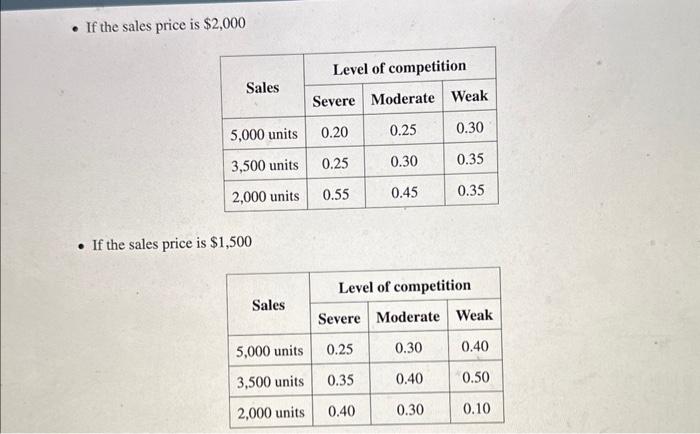

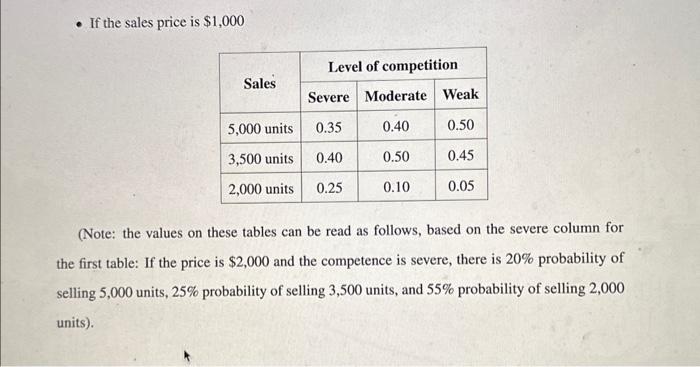

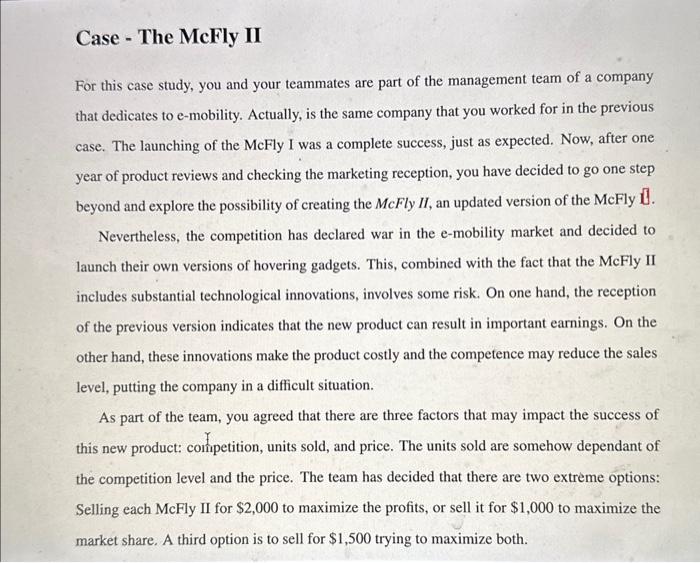

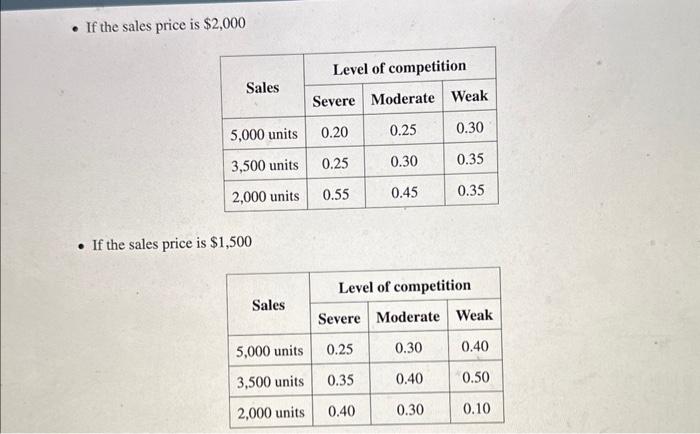

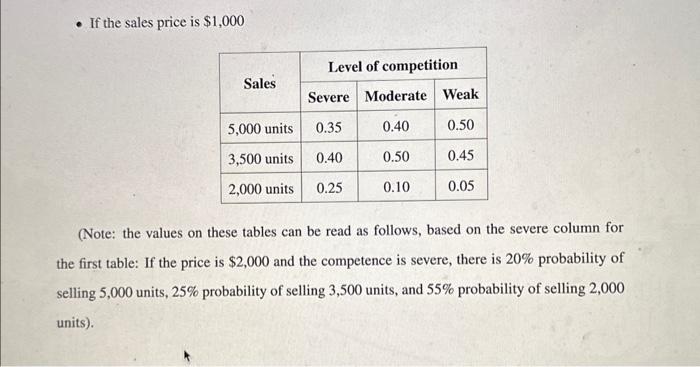

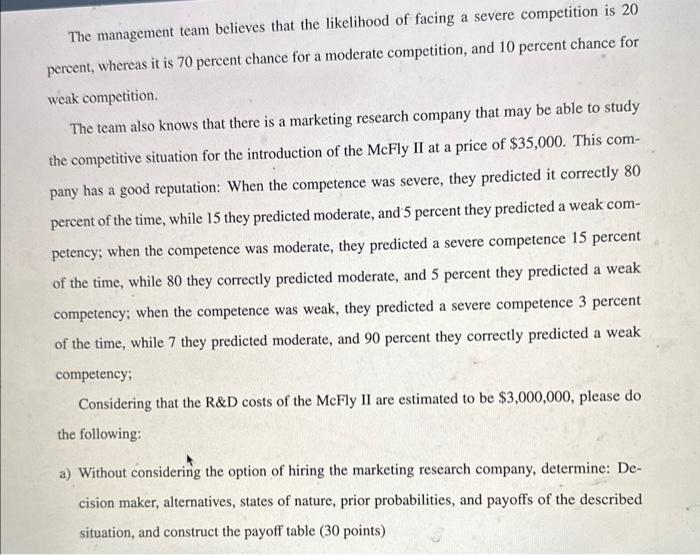

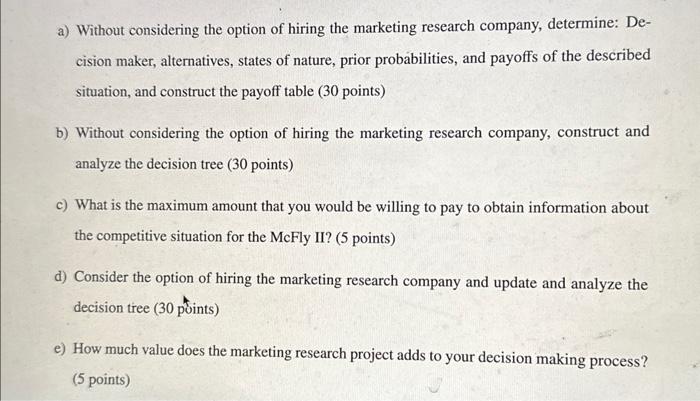

For this case study, you and your teammates are part of the management team of a company that dedicates to e-mobility. Actually, is the same company that you worked for in the previous case. The launching of the McFly I was a complete success, just as expected. Now, after one year of product reviews and checking the marketing reception, you have decided to go one step beyond and explore the possibility of creating the McFly II, an updated version of the McFly I]. Nevertheless, the competition has declared war in the e-mobility market and decided to launch their own versions of hovering gadgets. This, combined with the fact that the McFly II includes substantial technological innovations, involves some risk. On one hand, the reception of the previous version indicates that the new product can result in important earnings. On the other hand, these innovations make the product costly and the competence may reduce the sales level, putting the company in a difficult situation. As part of the team, you agreed that there are three factors that may impact the success of this new product: competition, units sold, and price. The units sold are somehow dependant of the competition level and the price. The team has decided that there are two extreme options: Selling each McFly II for $2,000 to maximize the profits, or sell it for $1,000 to maximize the market share. A third option is to sell for $1,500 trying to maximize both. - If the sales price is $2,000 - If the sales price is $1,500 - If the sales price is $1,000 (Note: the values on these tables can be read as follows, based on the severe column for the first table: If the price is $2,000 and the competence is severe, there is 20% probability of selling 5,000 units, 25% probability of selling 3,500 units, and 55% probability of selling 2,000 units). The management team believes that the Iiketinood or iacios a moderate competition, and 10 percent chance for percent, whereas it is 70 percent chance for a moderate co weak competition. The team also knows that there is a marketing research company that may be able to study the competitive situation for the introduction of the McFly II at a price of $35,000. This company has a good reputation: When the competence was severe, they predicted it correctly 80 percent of the time, while 15 they predicted moderate, and 5 percent they predicted a weak competency; when the competence was moderate, they predicted a severe competence 15 percent of the time, while 80 they correctly predicted moderate, and 5 percent they predicted a weak competency; when the competence was weak, they predicted a severe competence 3 percent of the time, while 7 they predicted moderate, and 90 percent they correctly predicted a weak competency; Considering that the R\&D costs of the McFly II are estimated to be $3,000,000, please do the following: a) Without considering the option of hiring the marketing research company, determine: Decision maker, alternatives, states of nature, prior probabilities, and payoffs of the described situation, and construct the payoff table ( 30 points) a) Without considering the option of hiring the marketing research company, determine: Decision maker, alternatives, states of nature, prior probabilities, and payoffs of the described situation, and construct the payoff table ( 30 points) b) Without considering the option of hiring the marketing research company, construct and analyze the decision tree ( 30 points) c) What is the maximum amount that you would be willing to pay to obtain information about the competitive situation for the McFly II? (5 points) d) Consider the option of hiring the marketing research company and update and analyze the decision tree ( 30 points) e) How much value does the marketing research project adds to your decision making process? (5 points) For this case study, you and your teammates are part of the management team of a company that dedicates to e-mobility. Actually, is the same company that you worked for in the previous case. The launching of the McFly I was a complete success, just as expected. Now, after one year of product reviews and checking the marketing reception, you have decided to go one step beyond and explore the possibility of creating the McFly II, an updated version of the McFly I]. Nevertheless, the competition has declared war in the e-mobility market and decided to launch their own versions of hovering gadgets. This, combined with the fact that the McFly II includes substantial technological innovations, involves some risk. On one hand, the reception of the previous version indicates that the new product can result in important earnings. On the other hand, these innovations make the product costly and the competence may reduce the sales level, putting the company in a difficult situation. As part of the team, you agreed that there are three factors that may impact the success of this new product: competition, units sold, and price. The units sold are somehow dependant of the competition level and the price. The team has decided that there are two extreme options: Selling each McFly II for $2,000 to maximize the profits, or sell it for $1,000 to maximize the market share. A third option is to sell for $1,500 trying to maximize both. - If the sales price is $2,000 - If the sales price is $1,500 - If the sales price is $1,000 (Note: the values on these tables can be read as follows, based on the severe column for the first table: If the price is $2,000 and the competence is severe, there is 20% probability of selling 5,000 units, 25% probability of selling 3,500 units, and 55% probability of selling 2,000 units). The management team believes that the Iiketinood or iacios a moderate competition, and 10 percent chance for percent, whereas it is 70 percent chance for a moderate co weak competition. The team also knows that there is a marketing research company that may be able to study the competitive situation for the introduction of the McFly II at a price of $35,000. This company has a good reputation: When the competence was severe, they predicted it correctly 80 percent of the time, while 15 they predicted moderate, and 5 percent they predicted a weak competency; when the competence was moderate, they predicted a severe competence 15 percent of the time, while 80 they correctly predicted moderate, and 5 percent they predicted a weak competency; when the competence was weak, they predicted a severe competence 3 percent of the time, while 7 they predicted moderate, and 90 percent they correctly predicted a weak competency; Considering that the R\&D costs of the McFly II are estimated to be $3,000,000, please do the following: a) Without considering the option of hiring the marketing research company, determine: Decision maker, alternatives, states of nature, prior probabilities, and payoffs of the described situation, and construct the payoff table ( 30 points) a) Without considering the option of hiring the marketing research company, determine: Decision maker, alternatives, states of nature, prior probabilities, and payoffs of the described situation, and construct the payoff table ( 30 points) b) Without considering the option of hiring the marketing research company, construct and analyze the decision tree ( 30 points) c) What is the maximum amount that you would be willing to pay to obtain information about the competitive situation for the McFly II? (5 points) d) Consider the option of hiring the marketing research company and update and analyze the decision tree ( 30 points) e) How much value does the marketing research project adds to your decision making process? (5 points)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock