Question: Answer question B 3. Your firm currently has a capital structure of 50% debt and 50% equity. Your after-tax cost of debt is 8% and

Answer question B

Answer question B

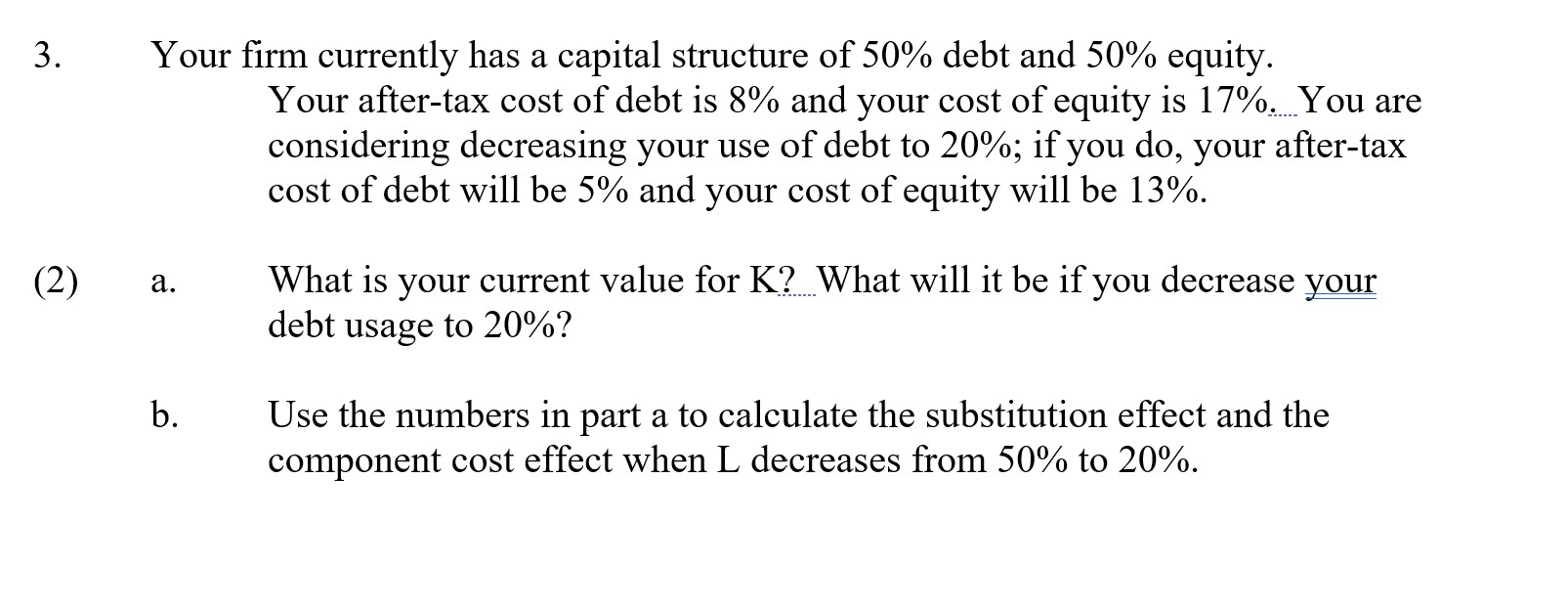

3. Your firm currently has a capital structure of 50% debt and 50% equity. Your after-tax cost of debt is 8% and your cost of equity is 17%. You are considering decreasing your use of debt to 20%; if you do, your after-tax cost of debt will be 5% and your cost of equity will be 13%. (2) a. What is your current value for K? What will it be if you decrease your debt usage to 20%? Use the numbers in part a to calculate the substitution effect and the component cost effect when L decreases from 50% to 20%. 3. Your firm currently has a capital structure of 50% debt and 50% equity. Your after-tax cost of debt is 8% and your cost of equity is 17%. You are considering decreasing your use of debt to 20%; if you do, your after-tax cost of debt will be 5% and your cost of equity will be 13%. (2) a. What is your current value for K? What will it be if you decrease your debt usage to 20%? Use the numbers in part a to calculate the substitution effect and the component cost effect when L decreases from 50% to 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts