Question: answer question D Problems (90 points- You must show calculations to receive full credit) 6. In the current year, the DOE LLC received revenues of

answer question D

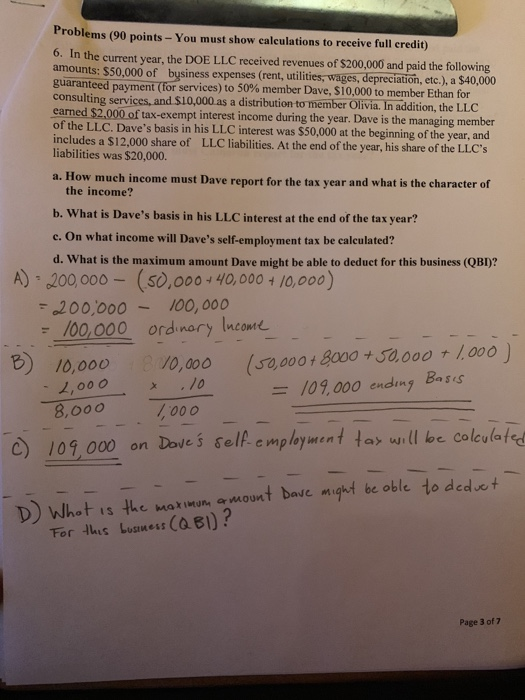

answer question D Problems (90 points- You must show calculations to receive full credit) 6. In the current year, the DOE LLC received revenues of $200,000 and paid the following amounts: $50,000 of bysiness expenses (rent, utilities, wages, depreciation, etc.,), a $40,000 payment(forservices) to 50% member Dave. S 10,000 to member Ethan for consulting services, and S10,000 as a distribution to member Olivia. In addition, the LLC earned $2.000 of tax-exempt interest income during the year. Dave is the managing member of the LLC. Dave's basis in his LLC interest was $50,000 at the beginning of the year includes a $12,000 share of LLC liabilities. At the end of the year, his share of the LLC's liabilities was $20,000. a. How much income must Dave report for th the income? b. What is Dave's basis in his LLC interest at the end of the tax year? c. On what income will Dave's self-employment tax be calculated? d. What is the maximum amount Dave might be able to deduct for this business (QBI)? A) 200, 000 - (s0,000* 40,000 + 10,000) 200,000 -100, 000 100,000 ordnary Ineome ) 10,00o o,000 0,0001 800030,000 1000 o o x .10 109,000 ending Bas - 1,00 1000 8,000 101,000 on Daves self.emplement tay wll be colevlet Whot is the maximon amount bave might be oble For us Luanes Ca Bl)? Page 3 of 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts