Question: Answer question e INTEGRATIVE PROBLEM Assume you recently graduated with a major in finance, and you just landed a job in the trust department of

Answer question e

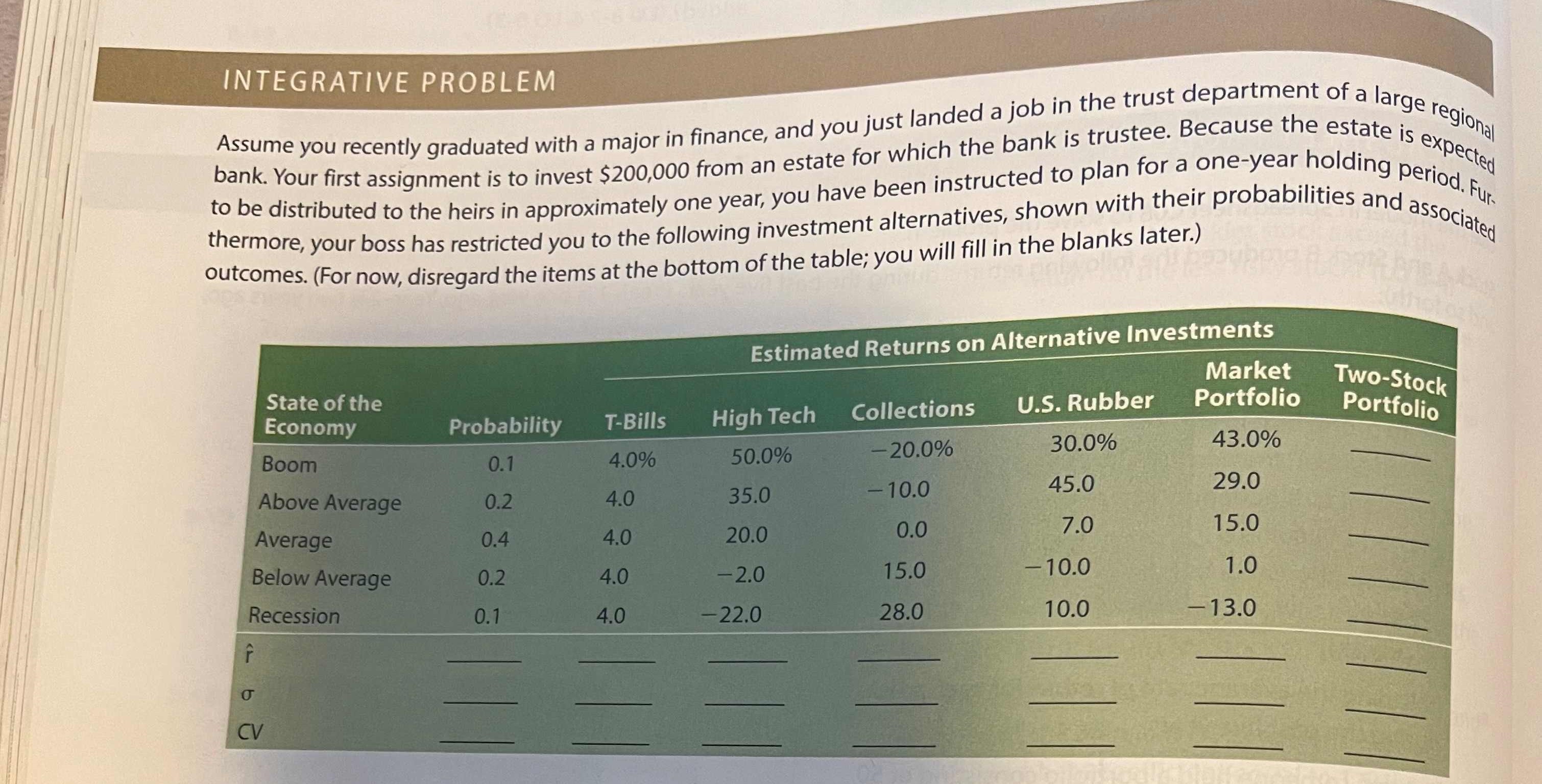

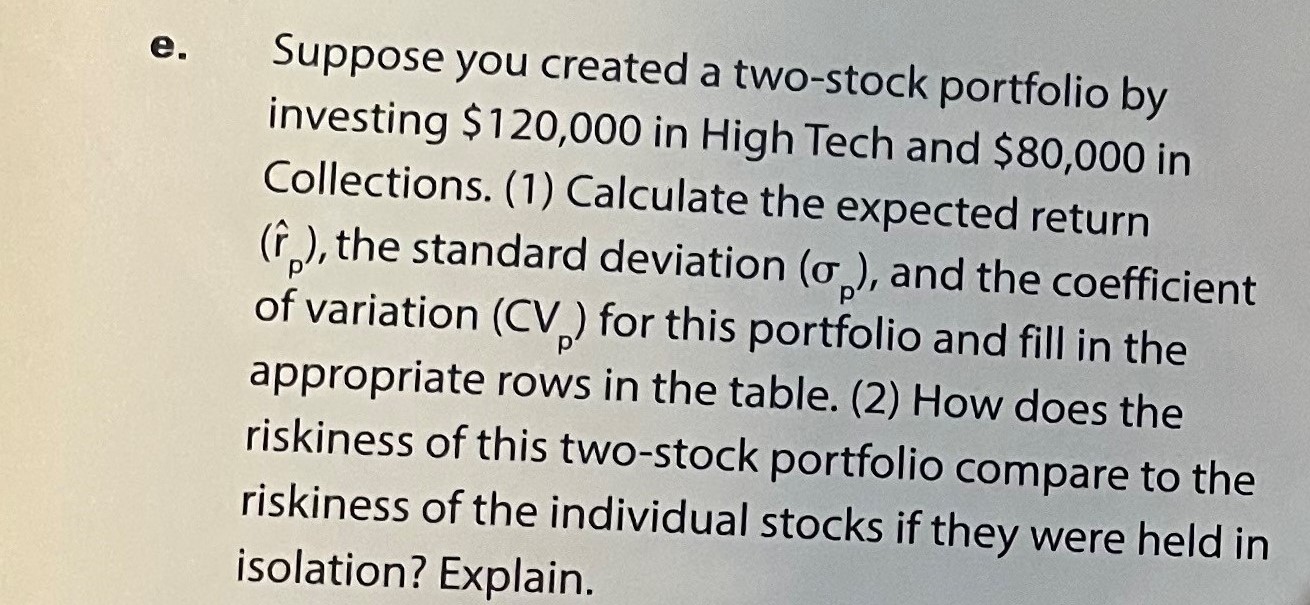

INTEGRATIVE PROBLEM Assume you recently graduated with a major in finance, and you just landed a job in the trust department of a large regiona bank. Your first assignment is to invest $200,000 from an estate for which the bank is trustee. Because the estate is expected to be distributed to the heirs in approximately one year, you have been instructed to plan for a one-year holding period. Fur. thermore, your boss has restricted you to the following investment alternatives, shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the table; you will fill in the blanks later.) Suppose you created a two-stock portfolio by investing $120,000 in High Tech and $80,000 in Collections. (1) Calculate the expected return (r^p), the standard deviation (p), and the coefficient of variation (CVp) for this portfolio and fill in the appropriate rows in the table. (2) How does the riskiness of this two-stock portfolio compare to the riskiness of the individual stocks if they were held in isolation? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts