Question: Answer questions 1, 2, 3, and 4 Problems Group A For all problems, P6-28A Accounting for inventory using the perpetual inventory syste assume the perpetual

Answer questions 1, 2, 3, and 4

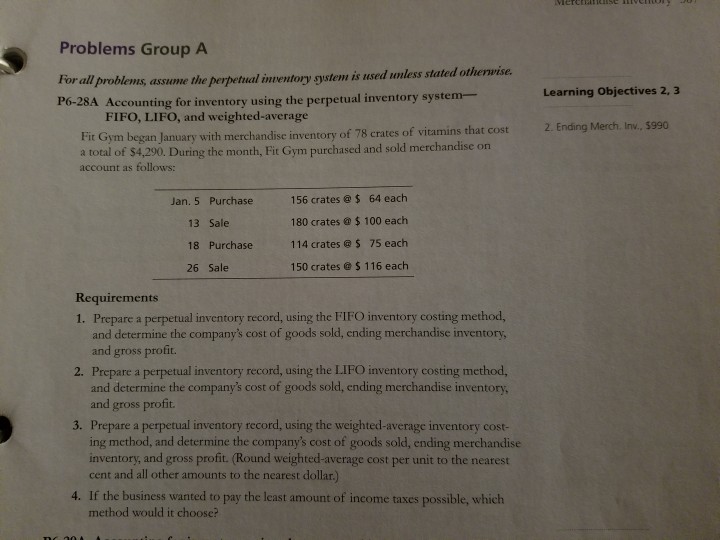

Problems Group A For all problems, P6-28A Accounting for inventory using the perpetual inventory syste assume the perpetual inventory system is used unless stated othewise. Learning Objectives 2, 3 FIFO, LIFO, and weighted-average Fit Gym began January with merchandise inventory of 78 crates of vitamins that cost 2. Ending Merch, Inv. $990 a total of $4,290. During the month, Fit Gym purchased and sold merchandise on account as follows: 156 crates $ 64 each 180 crates 100 each 114 crates @$ 75 each 150 crates $ 116 each Jan. 5 Purchase 13 Sale 18 Purchase 26 Sale Requirements 1. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory and gross profit 3. Prepare a perpetual inventory record, using the weighted-average inventory cost- ing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar) 4. If the business wanted to pay the least amount of income taxes possible, which method would it choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts